Regional Report: Russia

Like the rest of us, Russia’s oil and gas industry has been hammered by Covid and the price collapse. But the Bear’s pain, and recovery, is compounded by a pack of uniquely ursine issues.

Operationally, its challenges include lagging technology, burgeoning brownfield maintenance, and assets scattered across a vast landscape of environmental extremes. Add to those woes the stress of a Russian economy critically dependent on hydrocarbon revenues, a slate of U.S. sanctions aimed at limiting those revenues, and an inflexibility born of a tight relationship between government and a handful of major operators.

Still, Russia has immense resources, a government committed to its production, and a very capable industry. That nexus drives a wide scope of endeavors, from multilateral wells and hydraulic fracturing in Siberia to a return to offshore arctic operations in the Kara Sea. It’s also behind construction of a network of pipelines running east and west to external markets, construction of gas processing facilities, and launching of icebreakers to ply Arctic tanker routes.

DECARBONIZATION SWORD

Then there is the two-edged sword of decarbonization. While melting ice is opening up new Arctic opportunities, there are green market troubles brewing in Europe, where Russia’s poor pollution history and its commitment to fossil fuels versus “clean energy” is a growing customer-relations issue.

Some think a global green-energy transition presents an opportunity for Russia to capture global market share. Biden’s effort to cut carbon emissions may give a “short-term boost to energy companies in one of the world’s biggest polluters,” said Bloomberg author Aine Quinn. She points to Russian energy stocks that have gained 8% this year, compared to 2% for European oil and gas companies. Rosneft and Lukoil have, thus far, delivered total returns of 15% and 12% in dollar terms versus 2%for European companies, while also outperforming an index of global energy stocks.

And behold, OPEC+ nuanced production is up. Russian oil and gas condensate output increased in April 2021, gaining 2.5% to 10.46 MMbpd from 10.25 MMbpd in March, said Russia’s Interfax news agency. Last year at this time, total oil and gas condensate production declined for the first time since 2008 to 10.27 million bpd.

RESILIENT BUT VULNERABLE

Conservative monetary and fiscal policies may make Russia better prepared to weather the oil price shock, said Dr. Maria Shagina last year in an article for Foreign Policy Research Institute. But she said Covid and the oil price collapse would still take a toll on Russian energy majors’ profits and government revenues. Her report cited Skolkovo Energy Center estimates that overall losses would equate to 60% of export revenue and 30% of budget revenue.

Rosneft may be particularly vulnerable, said Shagina. The company incurred a $2.1-billion loss during first-quarter 2020 and expected a 10% decline in oil output. “Oil cuts and well conservation will be particularly painful for Rosneft, bound by long-term supply obligations under prepayment contracts with China,” she wrote. “Many Russian brownfields are overflooded and after their shutdown, 50% may never resume production, making the decision about which wells to close especially challenging.”

OPERATOR NOTES

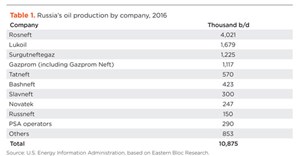

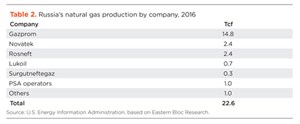

Russian oil and gas is dominated by a handful of companies and their subsidiaries. In oil production, the top firms are Rosneft, Lukoil, Surgutneftegas, GazpromNeft and Tatneft, Table 1. Gas production leaders are Gazprom Novatek, Rosneft, Lukoil and Surgutneftegas, Table 2.

Following is a snapshot of recent news and activity gleaned from company media releases and investor reports.

ROSNEFT

Rosneft launched two new key projects in 2020—the Erginsky License Area and the Severo-danilovskoye field—with potential liquids production of 45 MMbbl/year. In its 2020 year-end results, Rosneft reports 208 new deposits and 19 new fields were discovered.

Development drilling footage for the year increased 9.1% to total 10.9 MM m. About half of the drilling was done in-house. Newly commissioned wells totaled 2,600 units, including 1,800 horizontal units, up 5.8% from 2019’s level. Horizontal wells totaled 68% of newly commissioned wells. About 44% of all wells were hydraulically fractured.

In October 2020, RN-Yuganskneftegaz, Rosenft’s largest product subsidiary, set a monthly record in pumping 600 hydraulic fracturing operations. Each year, the subsidiary performs about 5,000 multi-stage hydraulic fracturing operations of up to 20 stages. A record extended-reach well with a 2,404-m horizontal section was drilled onshore in 2020.

The Arctic is a major focus of Rosneft, and the Russian Energy Ministry and the Russian Academy of Sciences recently recognized a team of company scientists for research on iceberg safety for oil and gas production facilities. Their study included theoretical insights and physical modeling in a ship model basin, as well as full-scale experimental works on towing icebergs in the Barents and Kara Seas.

In Central Russia, development drilling in the Erginsky cluster project added nine rigs last year. The cluster is part of Priobskoye field in the Khanty-Mansi Autonomous District.

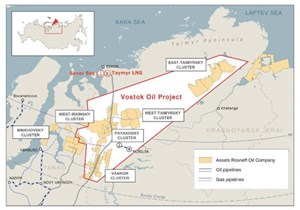

Rosneft enterprise RN-Vankor discovered a new field in Eastern Siberia. The discovery in the Vankor Cluster contributes to the Vostok Oil Project, Fig. 1. The Vostok project’s resource potential has more than doubled since its launch in 2009, due to the large-scale exploration. Crude reserves are up 20%, and gas reserves are up 54%, said Rosneft.

The Vostok mega oil project includes the creation of 15 towns to house oilfield workers; two airports; a seaport; some 800 km of line pipe; some 7,000 km of infield pipe; 3,500 km of electrical lines; 2,000 MW of electric power; and about 100,000 new jobs. Rosneft said it is expected to boost the country’s annual GDP by 2%.

The project lies in proximity to the Northern Sea Route, a transportation resource that Rosneft says will supply crude (up to 80 MMt by 2024) to both European and Asian markets.

SevKomNeftegaz, a joint venture between Rosneft Oil Company and Equinor ASA, produced its first million tonnes of oil from North-Komsomolskoye field, onshore in Western Siberia. Production reportedly has quadrupled since the venture was formed in 2017, due in large part to development of the Pokur formation’s sandy Cenomanian sediments at depths of 1,100 to 1,150 m.

Roseft cites advanced technology as key to the increase, including smart well completion systems and drilling methods. In 2020, SevKomNeftegaz set the record for the longest horizontal section (2,404 m) among single-bore horizontal wells drilled by Rosneft onshore.

A large gas and condensate field was discovered in the Nizhnedzherbinsky license area, in far Eastern Siberia. The Kulbertinov field reserves are estimated at over 75 Bcm of gas and 1.4 MMt of gas condensate. The field is in the Republic of Sakha (Yakutia), where large-scale geological exploration has discovered three fields in the last two years.

Kara Sea exploration yielded Rosneft’s second and third field discoveries in December 2020. The third, Rokossovsky field in the Vostochno-Prinovozemelsky 2 license area, has total reserve estimates of 514 Bcm of gas and 53 MMt of condensate, based on exploratory and appraisal drilling.

The second, Zhukov field, is in the East-Prinovozemelsky-1 license area, and has estimated deposits of 800 Bcm of gas. The first exploratory well, Universitetskaya-1, established Pobeda field in 2014. It is one of the world’s largest oil and gas fields, with total recoverable reserves of 130 MMt of oil and 422 Bcm of gas. Overall, more than 30 prospective structures have been identified in the three East-Prinovozemelsky areas, said Rosneft.

A stratigraphic drilling program in the North Kara Sea was completed in 2020. The first in the region and the northernmost on the Russian shelf, the project collected 6.5 tonnes of core samples from eight wells drilled to 90 m from the Bavenit survey drillship. Next is a series of analytical studies to improve forecast reliability of oil and gas potential with a new geological model.

LUKOIL

LUKOIL says about 55% of its oil production is from Western Siberia and 28% is from the Timan-Pechora basin in the northwest Russian arctic. In Western Siberia, the company told investors that this year it would continue efforts to improve drilling efficiency and scale new technologies for more horizontal wells with three-string designs.

It cites efficiency gains over the last year from three-string well construction that has reduced cost per well about 20%, compared to standard wells. Lukoil said it completed 187 of these wells in 2018-2020, including 55 multi-laterals. Small-diameter wells are also reducing costs by about 50%, by using lower-capacity rigs, and less metal in well construction.

In the North Caspian Sea in 2020, Lukoil said one production well was commissioned in Filanovsky field and two in Korchagin, and drilling programs are planned in 2021. Infrastructure work continues at Grayfer field, where production jackets and living platforms were installed last year.

Imilorskoye field in Central Russia’s Khanty-Mansi Autonomous District, exceeded 5 MMt of total oil output in 2020, since it started producing in 2014. LUKOIL says the total includes a 2020 increase of 20% over 2019 production.

The field added 117 production wells in 2020. In total, over 300 oil wells and 29 multi-well pads are in service. Eight new hydrocarbon reservoirs have been discovered since 2015. The field has estimated recoverable oil reserves of 100 MMt, much of that from low-permeability reservoirs.

LUKOIL says it has invested more than $9 billion in developing Russia’s sector of the Caspian Sea, where it has discovered nine fields estimated at 7 Bboe.

North Caspian Sea development is ongoing in several fields, said the company. In Valery Grayfer field, jackets for the accommodation block on the fixed ice-resistant platform were installed. Shipyards in Astrakhan are constructing topsides of both platforms for planned installation in 2021. The living quarters will accommodate 155 people. Production start-up is set for 2022 at the design rate of 1.2 MMt per year.

The company drilled an exploration well at the Severo-Rakushechnaya prospect, north of Valery Grayfer field. Korchagin field started Phase 2 drilling to focus on the eastern part of the field, and Filanovsky field launched its Phase Two development drilling campaign, which is aimed at maintaining oil production at 6 MMt a year. Exploration and production drilling is ongoing at other offshore fields, as well. Exploration is also active at the Khazri and Titonskaya prospects in the Central Caspian.

GAZPROMNEFT

Two new projects were highlighted in Gazprom Neft’s 2020 reported results. The Zima project, in Western Siberia, saw 70 wells completed during 2020. Its full-scale development began in 2020. Located in the Khanty-Mansi Autonomous Okrug-Yugra, Zima has potential resources of 840 MMt of oil. In the first year, the project’s Alexander Zhagrin field produced 1.0 MMt of hydrocarbons. Peak production at the flagship field is planned at 6.5 MMt of oil per year by 2024.

The second project was in the OGF (Otdalennaya Group of fields), in the southern part of the Yamalo-Nenets Autonomous Okrug on the Kara Sea, where the company is using cluster pads for development drilling. The fields produced their millionth tonne of oil in 2019. Most output came from two multiple-well cluster pads with eight wells at Zapadno-Chatylkinskoe field, where six more producers are planned.

Chayandinskoye oil and gas field production reached 1,000 t/day in 2020, says GazpromNeft, which calls it one of the most important fields in Eastern Siberia. Last year, a 70-km, 1.5 MMt of oil/year pipeline was commissioned to connect the field with the East Siberia—Pacific Ocean (ESPO) pipeline and the Asian-Pacific market.

Located in the Republic of Sakha in Northeast Russia, it has estimated reserves of 1.2 Bcm of gas, and 61.6 MMt of oil. Production from the field started in November 2019, and there are now 17 wells, with 37 additional multilateral “fishbone” design wells planned, Fig. 2. Production is expected to reach 3 MMtoe/year.

Bazhenov shale oil production is benefiting from new all-Russian technologies that cut 2020 production costs by 20% and increased production by 78% to 100,000 tonnes, says GazpromNeft. The high-profile project, to be completed this year, is examining a range of solutions for producing the Bazhenov formation.

In 2020, development efforts included construction of a 2-km horizontal wellbore and pumping a 30-stage hydraulic fracturing program with fluid injection at rates up to 16 m3/min. The well is in Palyanovskoye field in the Khanty-Mansi Autonomous Okrug, a 523,100 km2 region in the middle of the Western Siberia Plain. The program calls for eight wells to be drilled in the field.

This was the first time that all operations on such a complex well program have been undertaken, using exclusively Russian-produced equipment, said GazpromNeft. Creating a commercial vision of technology for working with the Bazhenov formation was the key outcome of 2020, said Kirill Strizhnev, Director General, Gazprom Neft/Technology Partnerships. “2020, in fact, saw us moving from pilot-testing to production-standard solutions—to actual deployment. We have put in place a pool of Russian companies and partners to provide oil services—on which basis, we have crossed an important watershed: we have proved it will be possible to develop the Bazhenov formation using domestic technologies.”

At Yuzhno-Priobskoye field in the same region, Gazprom Neft said it successfully tested a Russian-made rotary steerable system (RSS) The RUS-GM-195 RSS developed by the Russian company BURINTEKH was initially tested at the field in 2017. Final testing in October 2020 drilled a well section of more than 1,900 m.

Gazprom Neft said it used an integrated holistic model to optimize development of one of its most promising assets, the Alexander Zhagrin field, in the Kondinsky district of the Khanty-Mansi Autonomous Okrug.

The model was used to study 20 development scenarios that, over the next three years, will drill 87 new wells, with 90 more due to be commissioned. A digital twin reproduced the entire production process at each asset in a virtual environment.

“A field today is a complex set of interconnected systems—strata, wells, surface infrastructure and oil treatment facilities. For this to work effectively, we have to take the interdependent impacts of all components into account., said Alexei Vashkevich, Director for Technological Development, Gazprom Neft. “ Working out how to deal with this complex problem is helped by developing a digital twin—a computer model of the entire, massive system, able to predict how it is going to behave, going forward. An integrated model like this means you can test and verify various hypotheses, put together a variety of potential asset development scenarios, and select the best of these for implementation.”

- Russian Regional Report: Isolation 2.0 (June 2022)

- The Last Barrel: What a difference a war makes (May 2022)

- First Oil: End of an era for a Russian oil and gas icon (May 2022)

- The ESG perspective: A day without oil? (April 2022)

- Oil and gas in the capitals: Casualties of war (April 2022)

- Ukraine’s oil and gas industry supplies only a small part of the country’s needs (March 2022)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)