2022 Forecast: Activity outside North America will lead global recovery

After experiencing an unusually low level of activity during 2020, sparked by the Covid pandemic, drilling outside the U.S. grew at an 8.0% pace during 2021. And given burgeoning oil and gas demand, coupled with much-improved commodity prices, the stage is set for a noticeably better drilling performance in 2022.

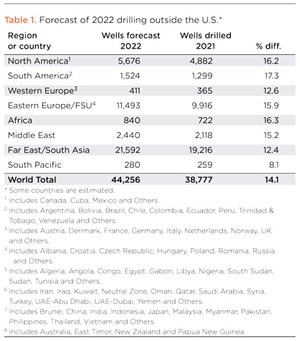

The number of wells drilled internationally increased from 35,918 in 2020 to 38,777 last year, Table 1. Five of eight regions worldwide posted gains last year, while three areas (Middle East, Africa and Eastern Europe/FSU) eroded further. For 2022, operators will have demand and commodity prices on their side, but they also will have to deal with supply chain issues and higher prices and/or spot shortages for oil and gas products and services. The situation for OCTG supplies will be a particular issue to keep an eye on.

Given the aforementioned factors, along with World Oil’s surveys of international petroleum ministries and departments, World Oil’s editorial staff forecasts 2022 international E&P activity, as follows:

- Canadian wells will rise 16.1%, while Mexican drilling will jump 18.0% higher

- Global drilling, excluding the U.S., will increase 14.1%; Table 1.

- Global offshore drilling is forecast to gain 14.5%, with increases expected in every region, Table 2.

After dropping an unprecedented 7.0% during 2020, worldwide crude and condensate production rose 0.6% last year, to 77.1 MMbpd, Table 3. The increase was a response to growing demand worldwide, as effects of the Covid pandemic lessened.

NORTH AMERICA

Outside the U.S., North American drilling is expected to increase 16.2% during 2022, with double-digit growth featured in Canada and Mexico.

Canada. All basic indicators of oil patch activity are trending up in Canada, but not all is well. Politics continue to be the biggest wild card in the country. The Trudeau administration’s anti-oil agenda continues to suppress optimism for a Canadian rebound.

Nevertheless, the Canadian oil and gas production outlook is positive for the near term, although the fate of the overall market is very much in the hands of the individual provinces. While the Albertan premier, Jason Kenney, continues his support for oil operations critical to the economy, the story is different on the Atlantic coast. In Newfoundland and Labrador, provincial premier Andrew Furey withdrew financing for offshore seismic operations, calling into question the government’s commitment to the offshore oil and gas industry.

For 2022, the Canadian Association of Petroleum Producers expects drilling to increase 16.1%, Fig. 1. Please turn to page 42 for the full Canadian forecast article.

Mexico. President Andres Manuel Lopez Obrador (AMLO) will continue his focus on meeting domestic demand, going so far as to cut crude oil exports to help satisfy the country’s need for gasoline and other refined products. As many as 300,000 bopd that would have been made available to the export market are now being dedicated to Mexico’s refiners, who have been operating at less than 50% capacity for the past several years.

Finances remain a challenge for Mexico’s Pemex, regardless of where the crude produced ends up. Mexico’s president, AMLO, has announced a slate of tax breaks for the state-owned operator to keep E&P work moving. Third-party operators will continue to face regulatory uncertainty, souring interest in Mexican prospects as well as individual asset performance. The future of Zama field, Mexico’s largest offshore operation, looks uncertain, as Pemex struggles to fund the $2 billion necessary to develop the project after it was wrested from joint-partner Talos Energy.

Increased domestic demand, along with Mexico’s skilled approach to price hedging, will help propel drilling growth. World Oil projects an 18% increase in Mexican drilling this year.

SOUTH AMERICA

Drilling across South America is expected to continue its strong upward trend from 2021, as high commodity prices and robust political agendas support new operations. In what’s now a historic shift, Venezuela will add new wells for the first time in several years, and offshore growth will be strong across the board in South America. Accordingly, World Oil sees drilling activity increasing 17.3% in 2022, with 1,524 wells forecast to be drilled across the region.

Brazil. President Jair Bolsonaro is continuing his strong support of the oil and gas sector, recognizing its role in supporting the broader Brazilian economy. Domestic oil demand is roaring back, and major operators are taking advantage of the favorable business environment created by recent tax reforms and regulatory updates. Drilling is projected to increase 18.7% in Brazil this year.

On Feb. 1, 2022, Petrobras announced that the FPSO Guanabara had arrived at Mero field on the Libra Block, in the pre-salt Santos basin, offshore Brazil, Fig. 2. Mero is the third-largest pre-salt field. During first-half 2022, this FPSO will be connected to wells and subsea facilities. Pending hook-up and final testing, the vessel should realize first production in the first half of the year. The field’s first production was postponed in April 2021, due to delays in constructing the FPSO, due to the Covid-19 pandemic. The FPSO Guanabara can produce up to 180,000 bopd and is the first of four platforms planned for Mero field.

Argentina. The Argentine government is looking forward to starting work on several Atlantic exploration blocks, auctioned in 2019, as a supplement to the Vaca Muerta shale formation on land. Environmental activists may stand in the way, however. Coming off a significant victory against new silver mines, green groups in Argentina have set their sights on stopping new offshore drilling. The government has asserted that drilling is key to meeting the nation’s economic needs. Yet, if history is any indication, the activists may tally another win. Nevertheless, drilling activity is expected to increase 12.1% in Argentina during 2022.

Venezuela. After years of battering by U.S. economic sanctions, Venezuela is taking advantage of the Biden administration turning a blind eye to the country’s oil production activities. Partner-in-sanctions Iran has resumed trading refined products for raw crude, and China has begun openly accepting crude shipments from the Maduro regime. Global oil demand makes for strange bedfellows; Biden recently extended, for a year, certain financial protections to ensure Venezuela’s Citgo retains ownership of oil refining facilities in the United States. With sanctions enforcement seeming to fall by the wayside, Venezuela is expected to drill its first new wells in nearly two years, later this year.

Colombia. With oil and coal accounting for half of the nation’s export revenue, Colombia continues to be a stable E&P player in the region. Clouds may be forming on the horizon, however, as presidential favorite Gustavo Petro seeks to plot an eventual end to fossil fuel production in the region. For the time being, interest in oil, and its contribution to Colombia’s coffers, remains strong. Drilling is expected to increase 49.6% in 2022.

Guyana and Suriname. The increasingly prolific Guyana-Suriname basin is coming into its own as the next frontier in offshore oil and gas development. ExxonMobil and Apache announced more significant discoveries, while offshore and oilfield service companies rapidly expand in-country operations to progress operations already underway.

WESTERN EUROPE

While renewable energy captures much of the attention of legacy players in Western Europe, the North Sea will continue its role as a key basin for future oil and gas development. Smaller players are both taking on assets from the majors and seeking new permits of their own, ensuring a robust market for oilfield services, for some years to come. Growth in Western Europe will be steady, increasing 12.6% in 2022.

Norway. Drilling activity on the Norwegian Shelf was flat last year, as renewable energy projects gain traction. Climbing oil price forecasts, along with recovering demand and challenged production from OPEC, will make Norway’s existing infrastructure all the more appealing for operators looking to add barrels. We project a fresh year of drilling growth offshore Norway, with the number of wells drilled to climb 4.4% in 2022.

In mid-February 2022, Sembcorp Marine announced completion of the Johan Castberg FPSO and its delivery to Equinor, Fig. 3. The FPSO then set off to Norway. Upon final completion in Norway, the FPSO is scheduled for deployment at Johan Castberg field in the Barents Sea, about 240 km from Hammerfest, Norway.

United Kingdom. The trend of supermajors selling legacy assets to smaller operators on the UK Continental Shelf continues, with ExxonMobil and Suncor leading the transition. The UK Oil and Gas Authority estimates that between 10 Bboe and 20 Bboe of recoverable petroleum reserves remain on the shelf, pointing to a long, albeit declining, future for offshore oil and gas production. Based upon the enthusiasm that smaller operators are showing for drilling the supermajors’ legacy assets, World Oil anticipates a 16.2% increase in drilling in the United Kingdom.

EASTERN EUROPE

Dominated by Russian activity, Eastern Europe (including the former Soviet Union states) will see drilling increase 15.9% in 2022, a nearly four-fold increase from the year prior.

Russia. Deputy Premier Alexander Novak pushed hard for higher OPEC production quotas early in 2021, while falling behind those quotas late in the year and into 2022. Focus remains on expanding natural gas export infrastructure, including both the Nord Stream 2 pipeline and other assets for Chinese delivery. Drilling in Russia is expected to increase by 16.2% in 2022. Rosneft is expected to lead the way among Russian operators planning greater drilling.

Outside of Russia, in the former Soviet Union, higher commodity prices are spurring renewed interest in drilling programs, with new wells drilled increasing 13.2% this year. Kazakhstan and Azerbaijan will set the pace among FSU countries for greater activity.

AFRICA

After a moderate 6.5% decline in drilling during 2021, African nations are expected to accelerate operations in 2022. A stabilizing political environment in Libya, combined with more offshore activity across the West African region, will see drilling rates increase 16.3% this year.

Egypt will continue its exploration efforts offshore the Mediterranean Sea with Chevron and ExxonMobil, and onshore exploration is still underway following discoveries in the Western Desert. Recently, APA Corporation (Apache) modernized and consolidated its PSC in the country and will increase investment in Egypt, accordingly. World Oil projects Egyptian drilling rates will increase 9.3% this year.

Libya faces a long road back to its role as a major contributor to OPEC production. Infrastructure budget challenges, regional skirmishes, and even weather issues are combining to keep Libyan barrels off the market. Despite these troubles, drilling activity is increasing, with wells drilled expected to climb 5.9% during 2022.

Nigeria is exploring a post-supermajors future for its oil and gas industry. A renewed focus on environmental integrity and support of domestic industry will see local operators like Heirs Oil & Gas take over from legacy operators, such as Shell. Drilling activity in Nigeria is projected to increase 15.4%.

Angola is seeking to reverse the tide of dwindling outflows by increasing the inventory of new fields available for development. Chevron’s Angola subsidiary recently signed a 20-year extension for Block 0, representing an important commitment by Chevron and its partners, Sonangol, TotalEnergies, and Eni Angola to continue E&P activity. As such, World Oil expects drilling in Angola to increase 16.2%.

Ghana. Tullow Oil and its partners are investing over $4 billion over this decade through their ambitious “Value Maximization Plan,” which will deliver over 50 wells. In April 2021, Tullow began a multi-year, multi-well campaign, drilling four wells during the year, consisting of two Jubilee production wells, one Jubilee water injector well and one TEN gas injector well. The J56 production well went onstream in July 2021.

The Value Maximization Plan also focuses on a program of operational turnaround, which is targeting in excess of 95% uptime at both FPSOs, Fig. 5. Tullow is also making sure that both fields continue to supply natural gas, consistently and reliably.

MIDDLE EAST

Among the world’s regions, the Middle East has been at a high rate of drilling activity, and that trend is set to continue. After taking extraordinary measures to support oil prices during the worst of the Covid pandemic by throttling output, key players are ready to open the taps, albeit in a measured fashion. With OPEC’s global oil demand projections strong through 2023, there looks to be no shortage of buyers for every barrel and molecule produced. World Oil expects drilling across the region to increase 15.2% this year.

Saudi Arabia. In addition to maintaining oil output, Saudi Aramco has awarded $10 billion of contracts for the vast Jafurah field development. This is a major effort to develop unconventional gas and condensate reserves. Production is expected to reach up to 2.0 Bcfd of sales gas, 418 MMcfd of ethane and around 630,000 bpd of gas liquids and condensates by 2030. The project aims to meet rising demand for high-value petrochemicals feedstock, complement Aramco’s focus on hydrogen, and support expansion of its integrated gas portfolio. We predict that Saudi Arabian drilling will jump 15.3% higher this year, Fig. 6.

Iraq is the Middle East’s second-largest oil producer, but it continues to be bedeviled by output challenges. Most of its OPEC output targets have been missed, even when accounting for cuts due to slumping pandemic demand. The nation continues its search for a buyer for ExxonMobil’s stake in the 20-Bbbl West Qurna 1 oil field, after which production could be anticipated to improve. Drilling in Iraq is set to increase 13% in 2022.

UAE-Abu Dhabi. The government-owned Abu Dhabi National Oil Co. (ADNOC) is continuing its quest to increase output of unconventional gas, while also exploring new alternative-fuel ventures. UAE Energy Minister Suhail Al-Mazrouei is keen to take the title of world’s largest LNG exporter away from the U.S., Australia or Qatar (whichever one is leading at any moment), as global demand for the fuel reaches record highs.

On Feb. 3, 2022, ADNOC announced the discovery of natural gas resources offshore Abu Dhabi. Interim results from the first exploration well in the Offshore Block 2 Exploration Concession, operated by Eni, indicate between 1.5 Tcf and 2.0 Tcf of raw gas in place. World Oil expects Abu Dhabi drilling to increase 20.5%, up significantly from 2021’s modest increase.

Oman is the Middle East’s largest oil producer outside of OPEC and is expected to maintain a rapid drilling pace in 2022. In addition to conventional oil and gas production, Oman is working with TotalEnergies to develop low-carbon LNG production and export facilities. Meanwhile, an agreement has been struck with BP to jointly develop a multi-gigawatt renewable energy and green hydrogen program by 2030. Oil and natural gas remain the primary focus, however, and drilling is expected to increase 5.8% this year.

FAR EAST

China’s drilling programs typically set the pace for the Far East average overall, and this year is no exception. Building upon an already sprawling drilling program, China will help lead the region to a 12.4% increase for 2022.

China. A commitment to reduce fossil fuels to 20% of its total energy mix by 2060, plus an economy that’s still recovering in fits and starts from the pandemic, would be enough to slow any country’s drilling activity. Yet, China will continue to be the world’s leading driller of oil and gas wells, with World Oil projecting a 12.3% increase in activity during 2022.

China’s national oil companies, CNPC, CNOOC and Sinopec, are expected to spend over $120 billion on drilling and well services by 2025, to help meet rising domestic oil and gas demand.

Indonesia. A subsidiary of state firm Pertamina is preparing to support a massive work plan, to drill 400 to 500 new wells in the Rokan Working Area this year. Activity should be up about 14% nationwide, including a 10% boost offshore, Fig. 7.

Malaysia. State company Petronas awarded six of 13 offshore exploration blocks offered in the recently concluded bidding round. The six blocks were awarded to existing and new operators.

SOUTH PACIFIC

In the South Pacific, the region is mostly a two-country realm of activity (Australia and Papua New Guinea), and upstream work has become increasingly gas-focused. We expect the region’s drilling to increase by a relatively modest 8.1%, to 280 wells.

Australia is maintaining its ambition to become the world’s largest LNG exporter (Fig. 8), but cost overruns and domestic shortages present challenges. And yet, new drilling is at the center of Australian plans to improve tax revenue while meeting domestic needs. World Oil expects the country’s drilling to increase 9.2% this year. The heightened activity is expected to be led by Santos and a number of smaller, independent explorers.

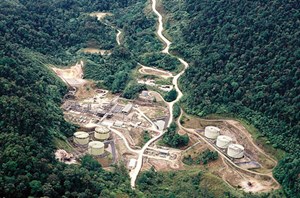

Papua New Guinea will see drilling increase slightly this year, as the pandemic recovery gathers pace and delayed projects are brought back online. In December 2021, Santos completed its acquisition of Oil Search Limited and all its holdings, including the oil fields (Fig. 9.) of Papua New Guinea and a share of the PNG LNG project operated by ExxonMobil. Meanwhile, the country’s dominant drilling contractor, High Arctic Energy Services, returned one of its rigs back to service after a long inactive period.

- Rugged, explosion-proof computers safeguard offshore rigs (January)

- What's new in exploration: A fresh look at Venezuela with the benefit of hindsight (January)

- Drilling advances: Bottlenecks? What bottlenecks? (January)

- The evolution of remote-controlled FPSOs (January)

- Flexibility and modularity enable tailored solutions for challenging shale plays (December 2025)

- How space tech can help autonomous oil rigs become a reality (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)