Oil and gas expansion accelerates as outlooks improve significantly

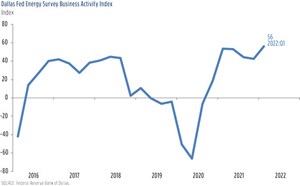

Activity in the oil and gas sector accelerated during first-quarter 2022, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—jumped from 42.6 in the fourth quarter to 56.0, reaching its highest reading in the survey’s six-year history, Fig 1.

OVERVIEW

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District (Texas, northern Louisiana, southern New Mexico).

Methodology. Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase.

When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the previous quarter. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Data were collected March 9–17, and 141 energy firms responded. Of the respondents, 91 were exploration and production firms and 50 were oilfield equipment/service firms.

Special questions asked of executives for this quarter include an annual update on breakeven prices by basin; expected firm growth in crude oil production; anticipated changes in employee head counts for 2022; the oil price needed to return publicly traded producers to growth mode; and the primary reason that publicly traded producers are restraining production growth despite high oil prices.

OIL & GAS PRICES

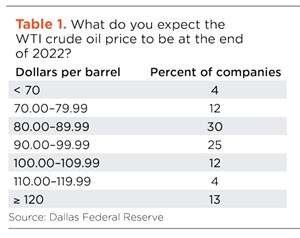

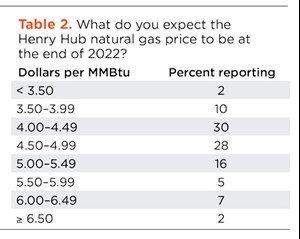

On average, respondents expect a West Texas Intermediate (WTI) oil price of $93/bbl by year-end 2022; responses ranged from $50/bbl to $200/bbl, Table 1. Survey participants expect Henry Hub natural gas prices to average $4.57 per million British thermal units (MMBtu) at year-end, Table 2. For reference, WTI spot prices averaged $103.07 per barrel during the survey collection period, and Henry Hub spot prices averaged $4.65 per MMBtu.

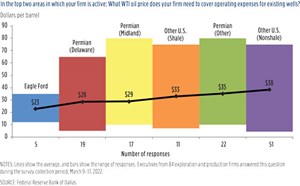

One of the special questions posed to executives was “In the top two areas in which your firm is active, what WTI oil price does your firm need to cover operating expenses for existing wells?” The results shown in Fig. 2 are quite interesting. Among shale plays in the 11th Fed District, they show a low of $23/bbl in the Eagle Ford shale to a high of $35/bbl in Permian sections other than Midland and Delaware. In non-shale plays, the figure is $38/bbl.

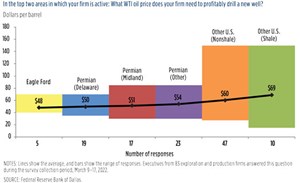

An additional special question asked was “In the top two areas in which your firm is active, what WTI oil price does your firm need to profitably drill a new well? The results, as displayed in Fig. 3, were very divided. They averaged $48/bbl in the Eagle Ford and $50 to $54 in the various sections of the Permian. But the price required to drill a new well jumped to an average $60/bbl in non-shale plays, and it climbed further to an average $69/bbl for shale plays outside the Eagle Ford and Permian.

OIL PRODUCTION

Oil production increased at a faster pace, according to executives at E&P firms. The oil production index rose sharply from 19.1 in fourth-quarter 2021 to 45.0 in first-quarter 2022. Similarly, the natural gas production index advanced 14 points, to 40.0.

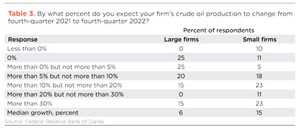

Meanwhile, one of the special questions asked was “By what percent do you expect your firm’s crude oil production to change from fourth-quarter 2021 to fourth-quarter 2022? The results for that question can be seen in Table 3. Executives from 82 E&P firms answered this question during the survey collection period. Small firms are defined as producing less than 10,000 bpd in fourth-quarter 2021, while large firms produced 10,000 bpd or more. Responses came from 62 small firms and 20 large firms. As can be seen, the answers were spread out over a variety of ranges, although smaller firms tended to project larger growth rates, and larger operators were more restrained.

COSTS/FACTORS

Costs increased for a fifth straight quarter. Among oilfield equipment/service firms, the index for input costs increased from 69.8 to 77.1—a record high. Only one of the 50 responding oilfield equipment/service firms reported lower input costs this quarter. Among E&P firms, the index for finding and development costs advanced from 44.9 in fourth-quarter 2021 to 56.0 in first-quarter 2022. Additionally, the index for lease operating expenses also increased, from 42.0 to 58.9. Both indexes reached highs for the survey’s six-year history.

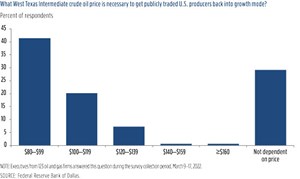

Given the rising costs, one would logically want to know at what oil price producers think that they can opt for production growth. Accordingly, another special question asked them, “What West Texas Intermediate crude oil price is necessary to get publicly traded U.S. producers back into growth mode?” As displayed in Fig. 4., roughly 40% of executives said a price of $80/bbl to $99/bbl. Another 20% of respondents said $100/bbl to $119/bbl, and a few went much higher. Interestingly, nearly 30% said that whether to grow production was not dependent on any specific price.

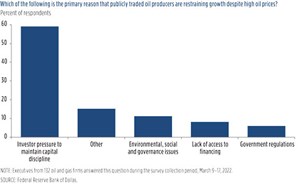

Following onto that topic, another special question asked executives, “Which of the following is the primary reason that publicly traded oil producers are restraining growth despite high oil prices?” As seen in Fig. 5, the number-one answer, by far, was “investor pressure to maintain capital discipline,” at 59%. The remaining 41% of executives answered either, “other,” “ESG,” “lack of access to financing,” or “government regulations.”

OFS SECTOR

Oilfield equipment and service firms reported improvement across all indicators. The equipment utilization index remained elevated, but it edged down from 51.1 in fourth-quarter 2021 to 50.0 in first-quarter 2022. The operating margin index advanced from 11.6 to 21.3. The index of prices received for services jumped from 30.3 to 53.2, a record high.

EMPLOYMENT TRENDS

All labor market indexes in the first quarter reached record highs, pointing to strong growth in employment, hours and wages. The aggregate employment index posted a fifth consecutive positive reading and increased from 11.9 to 28.0. The aggregate employee hours index jumped from 18.0 to 36.0. The aggregate wages and benefits index also rose, from 36.6 to 54.0.

Six-month outlooks improved significantly, with the index climbing from 53.2 last quarter to 76.3, a record high. The outlook uncertainty index also jumped from -1.5 to 31.9, suggesting uncertainty became much more pronounced this quarter.

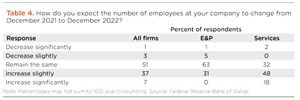

One additional special question asked executives, “How do you expect the number of employees at your company to change from December 2021 to December 2022?” As detailed in Table 4, the leading answer was “remain the same,” with 51% of all companies selecting that answer. Yet, there were differences. A whopping 63% of E&P firms chose this answer, while only 32% of service companies did the same. The “increase slightly” option was chosen by 37% of all firms, but that also broke out to 31% of E&P firms and 48% of service companies. Overall, it’s a somewhat optimistic outlook for upstream employment.

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- Industry at a glance (June 2023)

- Industry at a glance (May 2023)

- Management issues- Dallas Fed: Oil and gas expansion stalls amid surging costs and worsening outlooks (May 2023)

- Executive viewpoint (April 2023)

- Global offshore market is on the upswing (April 2023)