The reserves replacement dilemma: Can intelligent digital technologies fill the supply gap?

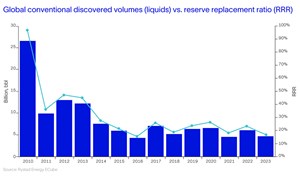

One of the challenges facing the oil industry today is reserves replacement. Globally, oil reserves are being consumed faster than they are being replenished. According to Rystad Energy, discovered volumes are at record lows, and the reserve replacement ratio (RRR) is 16%, meaning for almost every six barrels produced, only one is replenished, Fig. 1. Adequate reserves replacement becomes more critical, as the world’s energy demand is projected to rise over the next 10 to 20 years.

Although the RRR depends on many factors, such as reservoir drainage volume and efficiency, the world’s current reserves will eventually diminish as assets age. Even with today’s predictions, the ongoing energy transition, and the higher penetration of renewable and low-carbon energy sources, oil and gas are expected to contribute close to 50% of the global energy mix by 2050 (IEA, World Energy Outlook, 2023: Stated Policies Scenario (STEPS), and S&P Global Commodity Insights, 2023: Inflections Base Case Scenario). Although demand may be lower than today, hydrocarbons will still be required thereafter, and a supply shortage could slow the energy transition and lead to disruptions in the global energy landscape.

Strategic solutions to bridge the gap. Replenishing reserves challenges the industry as it adapts to tighter cost constraints and increased capital discipline. Economic dynamics have motivated operators to do more with the assets they have, including mature assets, to produce more from existing reserves. Today, more than 62% of the world’s production comes from mature assets, and this percentage is expected to grow to nearly 80% by 2030 (Rystad Energy UCube, 2023).

Ensuring long-term sustainable operations and meeting future energy demand means oil and gas companies must find new barrels to replace the consumed reserves. The best solutions will be economically advantageous, prioritizing adding reserves and producing them quickly while minimizing capital intensity and environmental footprints. Assessing how potential reservoirs can generate future cash flow and investment is also crucial.

It all comes down to reserves replacement and producing more from the reserves we already have. Operators are achieving all the above through a multitude of solutions, driven by an appetite for the best options to maximize existing asset recovery and explore nearby or new reservoirs to replenish supply. Using a mix of strategies, the trends to foreseeably gain momentum well into the future will focus on replacing reserves economically, efficiently, and with manageable environmental impacts.

Infrastructure-led exploration (ILX): Accelerating exploration to production. One of the ways operators are replenishing their reserves is through near-field exploration, also known as infrastructure-led exploration or ILX. This approach leverages existing infrastructure to guide exploration in areas of nearby reserves or producing fields. The idea is to find reserves within proximity to infrastructure already in place, where a field can be tied back and produced, specifically oil in a reservoir that wasn’t previously extracted. It is a strategy that involves minimized upfront investment, expedited production and, in many cases, lower carbon per barrel.

Another advantage is that ILX often targets areas near regions or hubs with existing transportation networks, allowing for more efficient development and monetization of discovered reserves. Discovery drilling, alone, is not only capital-intensive in terms of how fields are developed and produced but also in how the hydrocarbons are moved to where they are sold. Proximity to facilities for transportation minimizes logistical challenges associated with bringing newly discovered reserves into production. For operators, ILX is a solution that further maximizes existing assets and can enhance project economics and maximize returns on investment.

Frontier exploration: Venturing uncharted territories. Despite limited capital investment for exploration, the industry has seen big moves in recent years from oil and gas majors securing reserves in new basins and regions worldwide. Some companies complement their infrastructure-led exploration strategies with frontier exploration, pursuing more prolific discoveries. From a notable entry in India to developments by several operators in Sri Lanka and Guyana, venturing into new territories addresses the growing global demand for energy.

Exploration efforts have led to significant discoveries in regions with either very limited or no pre-existing infrastructure. Namibia, for instance, has witnessed some of the largest finds. A major gas discovery in Cyprus, an area lacking infrastructure for gas production and transportation, represents an opportunity to bring secure and affordable energy access to a region in need. While drilling in areas without infrastructure requires sufficient time between discovery and first oil, projects can be accelerated, as demonstrated by a major gas discovery in Egypt that reached first production in less than three years. Overall, companies drilling deepwater wells at great depths are in completely new exploration areas and are pushing the boundaries with similar campaigns in other regions around the world.

Interventions: Maximizing existing assets. The industry has progressively leaned toward interventions to meet short-term demand, with more production expected to come from mature fields. Operators are producing more from these assets through different intervention mechanisms, including enhanced oil recovery—both secondary and tertiary. Interventions accelerate production from existing reserves, bridging the gap between discovery and extraction. Lower capital expenditure and shorter investment timelines are advantages of intervention.

In some world regions, interventions have increased to help slow declining production and facilitate securing more hydrocarbons that are produced domestically. In 2022, for example, intervention activities on the UK Continental Shelf contributed nearly 40 MMboe (North Sea Transition Authority, Wells Insight Report 2023). However, many interventions don't meet operational goals in terms of incremental barrels, due primarily to reactive and siloed approaches, which tend to be more costly, compared with proactive measures that can help resolve the issue before escalation. Proactive intervention contributes to reduced cost of the value chain, with a 30% lower cost per barrel and 33% lower carbon footprint per barrel, as opposed to infill drilling to increase production.

Improving ILX through new technologies. ILX is especially efficient for achieving additional reserves, with numerous benefits that are economically favorable and expedite production. Digital and new, novel technologies have transformed ILX, pioneering better solutions for the industry. They are now what makes all its capabilities possible. Operators now have the advantage of finding reservoirs near established infrastructure, and that can be new value from prospects for production. Advanced technologies make this happen with greater certainty and at the speed that the job demands. Ultimately, it is designed to determine the producibility and commerciality of the reservoir.

Now, a new digital workflow developed collaboratively by SLB and major operators brings together the near-wellbore understanding of rock and petrophysical properties with fluid and deep permeability measurements. The intelligent ILX workflow (Fig. 2) derisks the reservoir evaluation and subsurface understanding. Before the job, an a-priori model is built to create numerous geological context scenarios of the well location, based on existing knowledge and data, such as neighboring well and seismic data. In real time, the model is then updated with actual high-resolution geological and advanced petrophysical data that are collected, followed by history matching against dynamic reservoir characterization produced by the Ora intelligent wireline formation testing platform (Fig. 3) on the go. This generates a calibrated near-wellbore model and derisked geological scenario from which key insights for operational decision-making and the reservoir are extracted. To end, deep transient testing (DTT) derisks the geocontextual model at deep scale to deliver producibility metrics and inform on commercial viability.

Greater efficiency. New technologies create maximum efficiency that results in significant time-savings. Technologies that now use advanced automated steps enable rapid interpretation within hours, such as how the Ora platform DTT on wireline reduces dynamic reservoir evaluation time. A digital, fit-for-purpose, near-real-time 3D geocontextual model reduces conventional static modeling from weeks to days. The DTT also allows for conducting zone tests without the extensive environmental and logistical footprint associated with traditional drillstem tests.

Greater certainty. By integrating various data sources into calibrated 3D models, the intelligent ILX workflow provides a quantified derisking of reservoir uncertainties. Multiple model realizations honor the measurements, with history-matching pressure transient tests validating model parameters, while DTT helps determine commercial viability and project economics. This reduces the risk of mischaracterizing the reservoir and improves confidence in forecasts of well deliverability. With its rapid insights and multifaceted validation, the intelligent ILX workflow delivers the certainty needed to fast-track development decisions during the critical exploration time frame. Quantifying both the reservoir potential and the remaining risks leads to exploration and development plans with maximized value.

Accelerated time to production. The intelligent ILX workflow complements the operator’s subsurface workflows, integrating DTT with advanced geological and petrophysical measurements that help to derisk asset performance with confidence. By leveraging automated data processing, interpretation, and advanced modeling, critical reservoir insights are extracted within weeks instead of months. This enables rapid decisions, such as sidetracking, completion, well placement, and more—significantly shortening the project cycle time and accelerating production.

Early technology adoption. Given today’s cyclical industry, adopting new technologies early and collaborating to enhance workflows is more crucial than ever before. With easily accessible oil reserves already discovered or largely depleted, what remains are highly geologically complex reservoirs that require the latest advanced capabilities to locate and characterize with greater precision. Adopting automated and digitally integrated technologies catalyzes the process of quickly finding the best prospects early on. Additionally, new technologies open opportunities to access previously unreachable or uneconomical reservoirs, giving companies without the expertise in these latest technological innovations potential struggles to tapping important new sources of supply.

In recent years, SLB has seen a correlation between early technology adoption and success in deepwater projects. Companies that invest early in the latest technologies more often find themselves at the forefront of identifying and accessing new reserves. While the initial capital investment is significant, the individual technology costs pale in comparison to total project expenditure. These investments become increasingly apparent in the success rates of deepwater drilling projects, where advanced technologies enable enhanced reservoir characterization and evaluation of commercial viability. However, the disparity in success rates and early technology adoption, often dictated by financial constraints, may be a factor that limits access to the best available technologies.

Nevertheless, the industry's growing focus on ILX is one way that companies are attempting to mitigate costs over time and risks in the economic environment. To remain competitive and operationally sustainable for the long haul, leveraging technology is becoming more evident by the day, and SLB is driving energy innovation through collaboration to ensure that the industry and its customers succeed.

Fueling energy security. Advanced technologies that create efficiency and reduce project time also help to expedite energy security in many countries, where populations lack sufficient access, especially regions with limited infrastructure. Some countries can afford access to energy, whether it's gas or electricity. But a considerable slice of societies in other parts of the world have either no access or very limited access to energy, whether it is clean or not. From a global perspective, the demand for reliable, affordable energy is tremendous, and it is one of the biggest challenges that the energy transition aims to address—it drives economic progress and is necessary to help populations move out of poverty.

Infrastructure-led exploration plays an essential role in helping to keep up with the world’s energy demand. We know that the oil and gas industry’s shift toward interventions for increased production will only take us so far, for so long, and it needs to be accompanied with other strategies. For operators, ILX is conducive to economic factors that the industry contends with and allows expediting with the speed at which supply can reach the market. By prioritizing infrastructure-led exploration, it’s a solution that addresses reserves replenishment, contributes to energy security, drives economic prosperity, and lessens environmental footprint.

Despite the focus on cash flow and capital discipline, some oil and gas companies are diversifying investments into new energy sources, adding to the energy mix. However, operators, both large and small, still rely on revenue from traditional oil and gas operations, emphasizing the role of the reservoirs in the energy transition. The cash flow from traditional operations and production is crucial for funding the transition because of limited profitability in alternative energy, which is evolving as technologies mature and scale. Yet, new energy projects require funding from the oil and gas sector, and this is expected to remain essential for some time.

Conclusion. In the journey ahead, operators must pursue strategic solutions to bridge the gap between consumption and replenishment of oil reserves. The best strategy involves multiple approaches toward maximizing the potential of existing assets while simultaneously exploring new avenues for reserve replacement. ILX is gaining ground among operators, who are speeding up the process of bringing new reserves into production. The approach minimizes upfront investment, accelerates production timelines, and often results in a lower-carbon footprint.

Moreover, the innovative processes that harness automation and digitalization, such as the intelligent ILX workflow, can further enhance the efficiency, certainty, and speed of these projects, enabling rapid decision-making and shortening the project cycle time. Simultaneously, proactive interventions can help slow declining production rates and unlock additional hydrocarbons. By taking a proactive approach, operators can reduce costs, minimize environmental impacts, and extend the productive lifespan of their assets.

Operators can achieve long-term sustainable operations and meet future energy demands by balancing intelligent ILX, interventions, and selective frontier exploration in new basins and regions not only to replenish their reserves but also contribute to energy security and drive economic growth. Moreover, early adoption of the latest technologies, combined with collaborative efforts to enhance workflows, will be crucial in locating and characterizing complex reservoirs with greater precision and efficiency. Ultimately, a diverse energy mix supported by adequate investment in hydrocarbons and renewables will also be key to ensuring global energy security while progressing toward a lower-carbon future.

ABOUT THE AUTHOR

Li Dan is the reservoir product manager for the Reservoir Performance Division at SLB. She has extensive expertise in finding technological solutions for subsurface reservoir characterization challenges and innovating digital technologies that deliver actionable insights for operators. With more than 17 years at SLB, she leads a team that defines strategies and builds the blueprint for technologies that address the future needs of the industry, sustainably.