Oil markets brace for Venezuela shock as global supply glut deepens

(Bloomberg) – While the capture of Venezuelan President Nicolas Maduro following U.S. airstrikes marks a seismic geopolitical development, early signals suggest that the global oil market will largely take the move in its stride.

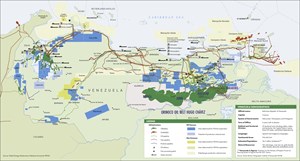

Venezuela’s oil infrastructure wasn’t affected after a series of U.S. attacks in Caracas and other states, according to people with knowledge of the matter. Key facilities such as Jose port, the Amuay refinery and oil areas in the Orinoco Belt are still operational, said the people, who declined to be named because the matter is confidential.

While Venezuela was once an oil-producing powerhouse, its output has declined precipitously over the past two decades and now represents less than 1% of global supplies. Recent U.S. pressure on Maduro’s regime, including the seizure of tankers carrying Venezuelan crude, forced the country to start shutting some oil wells.

President Donald Trump said during a press conference on Saturday that sanctions on Venezuela’s oil industry will remain in place and U.S. oil companies will help rebuild infrastructure and revive output. Such a reconstruction would be highly ambitious and most likely a distant prospect. In the meantime, worldwide oil supplies are expected to exceed demand by 3.8 MMbpd in 2026, which would mark a record glut, according to the International Energy Agency.

Crude prices have slumped in recent weeks to around $60 a barrel. One weekend retail trading product run by IG Group showed US crude prices at one point rising by close to $2 from Friday’s close.

“I assess that Brent crude prices will rise only marginally at the open on Sunday evening, by 1-2 U.S. dollars or even less,” said Arne Lohman Rasmussen, chief analyst at A/S Global Risk Management. “Even under normal conditions, a disruption of this magnitude is manageable for the market. In particular, all forecasts point to a significant oversupply in the first quarter, driven by seasonally weak demand and OPEC+ production increases.”

Venezuela is a member of OPEC, which along with allies including Russia is scheduled to meet Sunday. Their planned video conference is expected to see the group stick with a planned pause to production hikes, three delegates said earlier this week.

The tanker seizures in the Caribbean in recent weeks have spooked operators of sanctioned vessels. At least seven ships have reversed course or halted at sea, according to ship movements tracked Friday by Bloomberg. That adds to four others that turned away in the immediate aftermath of U.S. forces boarding the vessel Skipper in mid-December.

Despite the volatility of the past month, U.S. oil producer Chevron Corp. has continued to operate in the country under a sanctions waiver issued by the Trump administration.

“Chevron remains focused on the safety and wellbeing of our employees, as well as the integrity of our assets,” the company said in a statement on Saturday. “We continue to operate in full compliance with all relevant laws and regulations.”

The capture of Maduro raises speculation over the fate of the Venezuelan oil industry in the longer-term. The country is estimated to hold more oil reserves in the ground than Saudi Arabia, and over the past century it has attracted some of the biggest international operators.

But two waves of nationalization left a bad taste in the mouth of the likes of Shell PLC, Exxon Mobil Corp and ConocoPhillips. Exxon and Conoco later sought compensation after their assets were seized by the late President Hugo Chavez.

In addition to Chevron, Spain’s Repsol, Italy’s Eni SpA and France’s Maurel et Prom SA are also still present in Venezuela and partner in oil and gas ventures with state-owned Petroleos de Venezuela SA.

Trump said Saturday that U.S. companies would rebuild the Venezuelan oil sector and sell a “large amount” of oil to global buyers, including current customers and new ones. It wasn’t immediately clear which oil companies he was referring to and he didn’t specify how soon they would be able to begin production.

“History shows that forced regime change rarely stabilizes oil supply quickly, with Libya and Iraq offering clear and sobering precedents,” said Jorge Leon, head of geopolitical analysis at Rystad Energy.