ExxonMobil greenlights Whiptail oil project offshore Guyana, expects production to pass Venezuela

(Bloomberg) – Exxon Mobil Corp. formally approved its sixth oil development offshore Guyana that will make the Latin American nation a bigger crude producer than OPEC member Venezuela.

The Whiptail project will cost $12.7 billion and produce about 250,000 bpd as soon as the end of 2027, Exxon said in a statement Friday. Guyana’s overall daily crude capacity will climb to 1.3 MMbbl just eight years after the advent of the country’s oil production.

Guyana’s boom comes as neighboring Venezuela, a co-founder of the Organization of Petroleum Exporting Countries, grapples with years of underinvestment and international sanctions that slashed oil production and government revenues.

Guyana’s emergence as a major oil producer also is having vast social and economic consequences for a country of just 800,000 people. Oil revenues have allowed the government to unleash a wave of welfare and infrastructure spending while expanding crude supplies factored into a recent OPEC decision to maintain production caps in a bid to support prices. International crude prices have risen almost 20% this year to about $90 a barrel.

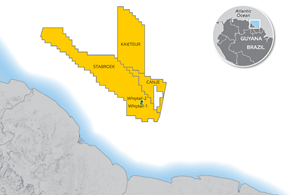

Exxon plans to drill 48 wells about 120 miles (190 kilometers) offshore Guyana that will feed a floating production, storage and offloading vessel, or FPSO, named Jaguar, the country’s national animal.

The FPSO will have 2 MMbbl of crude storage capacity, SBM Offshore NV, which will construct the vessel, said in a separate statement. SBM shares rose as much as 1.7% in Amsterdam.

Exxon expects Whiptail to ultimately produce more than 750 MMbbl. The cache was discovered in 2021.

Guyana’s offshore oil production growth is unlikely to continue at breakneck pace once Whiptail is online in 2027. Exxon has found enough oil and natural gas to support as many as 10 FPSOs, but is leaving its options open for the seventh project having now made more than 30 major discoveries.

“Some of it is not quite so easy reservoir-wise, but there’s a lot of resource,” Exxon’s Guyana country manager Alistair Routledge said in an interview. “We’re working through that inventory and figuring out what could potentially be next in the development.”

One option is for Guyana’s first gas-focused project, which is favored by the government. Other options include connecting more recent discoveries to existing production vessels rather than commissioning new FPSOs.

Since Exxon’s first Guyanese discovery in 2015, the nation’s known reserves have expanded to more than 11 Bbbl, attracting unwelcome interest from Venezuela. President Nicolas Maduro has ramped up rhetoric around his country’s historic claims to the Essequibo region that makes up two-thirds of Guyana’s land mass.

Meanwhile, Chevron Corp. is attempting to buy a share of Guyana’s oil bounty through a $53 billion takeover of Hess Corp., which holds a 30% share in the Exxon-led development. Exxon, which owns 45%, is disputing the change of hands via arbitration at the International Chamber of Commerce, arguing that it has a right of first refusal. Chinese oil giant Cnooc Ltd., which also owns a stake, joined Exxon in arbitration last month.