EQT to become “first large-scale natural gas company” in U.S. following $5.5 billion Mountain Valley Pipeline owner acquisition

(Bloomberg) – U.S. natural gas producer EQT Corp. agreed to buy back former unit Equitrans Midstream Corp. for about $5.5 billion in stock, the latest in a flurry of deals in the oil and gas pipeline industry.

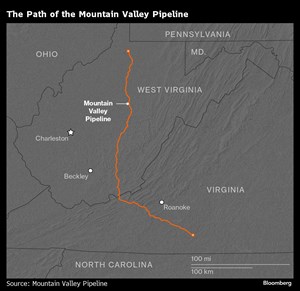

The transaction will give EQT control of the Mountain Valley Pipeline project. Championed by West Virginia Senator Joe Manchin but years behind schedule following legal battles and local opposition, the $7.6 billion conduit is due to be completed in the second quarter. It will take natural gas from the land-locked Marcellus shale basin in Appalachia — the biggest U.S. source of the fuel — to markets in the Southeast and, potentially, to liquefied natural gas (LNG() export terminals on the Gulf Coast.

EQT said Monday that the takeover will also help cut the break-even point at which it generates free cash flow, reduce the need for hedging and enhance its agility to cash in on increases in gas prices. After a spike in prices following Russia’s invasion of Ukraine in 2022, U.S. gas prices have tumbled, due in part to booming domestic production, and are currently trading close to a three-year low. EQT said earlier this month it will cut output in response to the price slump.

The deal will create “America’s first large-scale, fully integrated natural gas company,” EQT Chief Executive Officer Toby Rice said on a conference call with analysts.

The merged company, he added, “is going to give us the scale to be able to continue to deliver cleaner energy into markets, whether that’s domestically, replacing coal, meeting growing energy demand domestically, or internationally and servicing the burgeoning LNG market that we have.”

Rice said in October that EQT is evaluating LNG export projects along the East Coast. Gas companies in the US see great potential in LNG as exported gas typically fetches a higher price.

Equitrans was spun out of EQT in 2018 following a campaign by activist investment firm Jana Partners. The reversal of that move via Monday’s deal is the latest sign that the U.S. oil and natural gas sector may be moving back toward favoring the vertical integration of so-called upstream (production), midstream (pipeline and storage) and downstream (refining) assets. In January, gas-station owner Sunoco LP agreed to buy midstream operator NuStar Energy LP for about $6.5 billion.

Monday’s deal also adds to a string of recent transactions between midstream companies announced in North America, including ONEOK Inc.’s purchase of Magellan Midstream Partners LP in September and Energy Transfer LP’s takeover of Crestwood Equity Partners LP in November.

The acquisition of Equitrans is expected to close in the fourth quarter and will create annual cost savings of $250 million, EQT said. Equitrans shares rose 4.1% to $11.61 as of 9:33 a.m. in New York. EQT fell 7.5% to $34.70.

Each outstanding share of Equitrans will be exchanged for 0.3504 of a share of EQT, representing an implied value of $12.50 per Equitrans share. Equitrans has 436 million shares outstanding, according to data compiled by Bloomberg.

As a result of the deal, EQT shareholders are expected to own about 74% of the combined company, EQT said. Guggenheim Securities LLC is lead financial adviser to EQT on the transaction and RBC Capital Markets is financial adviser to the company. Barclays Plc and Citigroup Inc. are financial advisers to Equitrans.

Lead image: Sections of steel pipe for the Mountain Valley Pipeline in Bent Mountain, Virginia, U.S., in 2022. (Photographer: Robert Nickelsberg/Getty Images)