Energy Maritime Associates expects $126 billion investment in new Floating Production Units

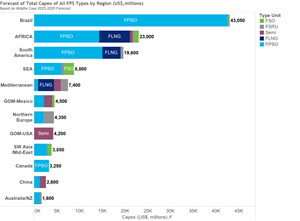

From 2025-2029, Energy Maritime Associates (EMA) expects orders for 119 Floating Production Systems, with a Capital cost of $126 Billion, in its mid-case forecast. Over 70% of this investment would go towards the 54 FPSOs. Brazil will remain the largest FPSO market, more than Africa and the rest of South America combined. Newbuilt hulls will be the norm going forward, although converted tankers and re-use of existing FPSOs will play a role, particularly for smaller developments.

Floating LNG export projects worth $14.3 billion are expected in Africa, Argentina, and the Mediterranean. These also will be mostly newbuilt units, with a select few conversions and redeployments. Floating LNG import projects worth $6.3 billion are forecast predominantly for Europe and South America. This FSRU demand will be met by a combination of newbuildings, conversion of older LNG carriers, and redeployment of existing units.

Production Semisubmersibles will continue to be popular for deepwater developments on both sides of the Gulf of Mexico as well as in China. Costs for these Semis has been driven down by repeat orders of a standardized design, such as for Shell’s Vito, Whale, and Sparta.

Industry capacity continues to be constrained due to high demand for traditional shipbuilding, as well as 60 floating production and storage systems currently on order. Finance remains the largest constraint for these multi-billion-dollar units. As a result, fewer lease contracts will be awarded, in favor of EPC or Build-Operate-Transfer (BOT) contracts. However, the BOT period is expected to be 5-7 years, rather than the two years seen in past awards.

Further details are included in EMA's 200+ page Floating Production Outlook Report 2025-2029, which covers:

- Summary of market & FPS types

- 5-year forecast for each FPS type

- 165 Projects in the planning pipeline

- 52 Production floaters and 8 storage floaters currently on order

- 22 Units currently available

- 55 Units that could be decommissioned in next two years

- 326 production floaters and 112 storage floaters currently in service

According to EMA’s Managing Director, David Boggs "Despite rising costs and geo-political uncertainty, the fundamentals of the floating production sector remain strong with a large number of developments in the planning pipeline. Offshore developments, particularly in deepwater, will remain attractive investments as they can offer a low cost per barrel and low CO2 per barrel. While mature areas, such as the U.K. North Sea are in decline, additional developments will continue in established regions including the Gulf of Mexico, Brazil and West Africa. In addition, developments in new frontier regions like Suriname and Namibia will require additional units. The biggest constraint is financing, particularly for leased assets. However, there are sources of capital available and interested in the long-term, infrastructure nature of floating production contracts, including bonds and private equity.”