Westwood: Optimistic outlook for onshore drilling following global uptick in demand and dayrates

Latest analysis from Westwood Global Energy Group, a specialist energy market research and consultancy firm, reveals a healthy recovery roadmap for the global land rig market, driven by higher commodity pricing and mounting pressures around energy security.

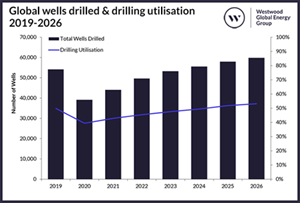

Westwood expects many regions to recover from the dramatic global downturn throughout 2020 better than previously expected. In 2020, levels reached a low of c.39,000 wells drilled onshore globally, but activity in 2022 is expected to reach 49,600 before climbing to c.60,000 wells in 2026.

The increase in drilling demand combined with higher commodity pricing has seen land drilling rig dayrates increase in a number of regions. The US in particular has seen dayrates increase by c. 25% over 2022, with average dayrates for 2Q 2022 reaching c. $26,500. Other regions such as the Middle East have more stable pricing due to longer term contracts and the presence of large National Oil Company (NOC) owned rig fleets.

As operators focus on developing more complex reservoirs, growing demand for super-spec (Tier 1), automated rigs in the US have also meant that these units are reaching dayrates in the mid-$30,000s due to tight supply. Outside of the US, countries such as Colombia and Oman are also experiencing high demand for high-spec rigs, with Colombia seeing dayrates reaching c. $45,000 for units with automation capabilities.

Todd Jensen, Research Analyst, Onshore Energy Services at Westwood said, “It’s encouraging to see the market begin to get back on its feet after the setbacks from 2020 and 2021, but there will still be significant oversupply of rigs globally, which we expect to see throughout the forecast period.

“The need for greater domestic energy production to ensure security of supply has no doubt had an impact on the speed of recovery that we’re seeing in comparison to last year’s forecast. The sanctions imposed on Russia following its invasion of Ukraine have led to higher-than-expected oil and gas prices, supporting rig demand globally. This, coupled with Western countries looking to plug the gaps left by Russian supply, has increased the need for greater domestic production and opened the door for other exporting countries to increase output.”

Despite a positive outlook for demand, the oversupply of rigs will remain a key factor in the sector, with demand unlikely to return to the pre 2014 downturn levels that led to a surge in newbuild rig construction. While utilisation in 2022 has increased to 45%, from 43% in 2021, and is forecast to grow to 53% by 2026, numbers will remain well below maximum capacity.

At the same time, the increased focus on automated rigs, which currently account for just 16% of the overall rig fleet, could also lead to demand outweighing supply of these rigs, a trend that is already being noted in the U.S. specifically, where some drilling contractors are expecting to exhaust their available supplies of super-spec rigs by mid-2023.