First oil

Just recently, this editor had to drive from Houston up to College Station, Texas, for an afternoon meeting. It’s about a 95-mi drive from the middle of Houston and around an hour-and-a-half to complete, assuming no traffic problems. It was a hot day, about 100oF, as central and southern Texas have been in an extended heat wave during June.

As I drove along the route, the vehicle radio was tuned to a major AM station in Houston, which has a strong signal that can prevail all the way to College Station. While the majority of the time was consumed with hearing discussions of political issues of the day, there also were news cut-ins on every half-hour. And it was the news cut-ins that caught my attention, as they were reporting that the Electric Reliability Council of Texas, better known to us locals as ERCOT (Fig. 1), was asking customers to voluntarily reduce electricity usage during daylight hours. This would include turning thermostats up a couple of degrees, and not using washers, dryers and dishwashers during the day.

Mind you, ERCOT said that these measures were strictly voluntary and that the electrical grid was still within normal operating parameters. But this also is the same ERCOT that so badly mismanaged the “deep freeze” winter weather that Texas experienced during February 2021. So, the June 2023 actions by ERCOT certainly conjured up thoughts in one’s head of potential grid failures during the unusual, sustained heat.

And here’s something else that ran through this editor’s head while driving through the heat to College Station: If this electrical utility firm and others across the U.S. (and similarly in other countries) are having this much trouble now keeping up with power demand, imagine what could happen if the Biden administration succeeds in shoving its EV agenda down the throats of American consumers. If millions more gasoline- and diesel-powered vehicles are swapped out for EVs, without proper thought being given to how we’re going to generate all the extra electricity needed, we’re all going to be in a heap of trouble.

Yet, that is exactly the path that Biden and his minions are pursuing. They seem willing to trash the economic status of millions of citizens, because they think the climate situation justifies radical action. But have we ever had a serious, reasoned discussion in the U.S. (much less in other countries) about how to balance achieving climate goals while ensuring that Americans continue to have access to affordable, abundant energy? Heck, no!

Because, at the end of the day, the only thing the Biden administration (and its political allies in Congress and the media) cares about is “control.” And using climate and energy as tools of control is irresistible to this collection of morons. This is what happens when the presidential cabinet is strictly composed of ivory tower idiots and political zealots. It also is a sorry indicator of the decline of U.S. effectiveness.

Optimism at URTeC. On a more positive note, this editor had the pleasure of attending the 2023 edition of the Unconventional Resources Technology Conference, held this year in Denver. There was a general feeling of optimism among attendees, even as the Baker Hughes Rig Count continued to slip a bit in the U.S., and costs for oilfield equipment, supplies and services remained inflated. That’s because the upstream technical innovation and progress showcased in paper presentations and exhibitions remains, for the most part, unabated. Another factor to consider is that many attendees felt that the continued strength and growth of international activity, including offshore work in several regions, will be enough to offset lackluster U.S. activity in the near term.

This optimism is reflected in the attendance figures for URTeC. Based on preliminary data at the end of the conference, upwards of 3,200 industry professionals attended the show in Denver. That’s not far off the 3,800 figure for URTeC in Houston last year, and is encouraging when one considers that a higher proportion of people had to travel to Denver to attend, as opposed to many more folks living directly in Houston. Granted, both the Houston and Denver figures are still below the pre-pandemic levels attained in 2019 (Denver, 5,200) and 2018 (Houston, 6,023, the all-time record), but given today’s realities, they’re still successful.

It's already official that URTeC will return to Houston and its George R. Brown Convention Center during 2024, but this editor has heard talk that it could go back to Denver in 2025. There is also rumor that alternating the conference between the two cities might be a permanent solution.

Supply chain prices remain high. Speaking of inflation, the June 15 bi-weekly “supply chain pricing market update” from Rystad Energy starts out with this statement: “Lower commodity prices would drive down U.S. shale service prices by over 20%.” That’s an interesting projection, but Rystad Senior Vice President Matthew Fitzsimmons is willing to back it up.

As he rightfully points out, in light of developments in recent years, it has become increasingly apparent that operators and suppliers must be prepared to navigate uncertainty and risk in their contractual agreements. So, this latest update tries to examine how fluctuations in commodity prices impact U.S. shale drilling and completions service prices.

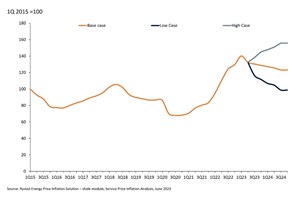

“We have assumed $100 and $60 per bbl of Brent for our high and low cases, respectively,” explained Fitzsimmons. “It has been observed that prices for onshore U.S. drilling and completions services have decreased by almost 5% since the beginning of the year until 2Q 2023. We expect these service prices to continue declining, albeit at a much slower pace, through 4Q 2024 (Fig. 2).”

Fitzsimmons notes that volatility in commodity prices could cause service prices to fluctuate dramatically in either direction. For example, drilling and completions pricing would rise 26% in a high commodity price environment and fall 20% in a low commodity price environment.

More specifically, spot land rig rates for 1,500-hp AC rigs have been falling in tandem with declining activity in 2Q 2023. Indeed, U.S. rig counts are down 35 month-on-month, 67 quarter-on-quarter, and more than 80 in the past eight months. “The buyer’s market is relatively fragmented,” observed Fitzsimmons, “with 330 operators running less than two rigs on average during 2022, accounting for 46% of the total land rig market.”

So, going back to the calculus of the situation, Rystad’s high case says that elevated prices would drive land rig rates above $38,000/day. Conversely, lower commodity prices would see rates fall to $23,000/day by Q4 2024.

A lower oil price environment, according to Fitzsimmons, would impact the frac services pricing even more drastically. As activity would decline, due to lower oil prices, frac crews would have an easier time than their rig counterparts relocating to different basins in the hopes of staying active. “This would increase basin-specific supply and drive service prices further down,” stated Fitzsimmons. “Service prices would fall by 25% in our low case through 4Q 2024.”

In addition, Rystad’s outlook says that prices for frac services and frac sand are expected to see marginal decreases of 4% from now until 4Q 2024. “In an elevated price environment, fresh frac water prices would rise 35% from their current levels,” observed Fitzsimmons. “A lower commodity price environment would see fresh water pricing drop by nearly 17%.”

We can’t disagree with most of this current outlook. It will be interesting to see how it actually works out.

Bringing rationality back to UK policy. Given the sometimes inexplicable energy decisions being made by the British government, were are pleased to bring you the thoughts of Nick Terrell, who is Chair of the UK Subsurface Task Force and Co-Founder, Carbon Catalyst. In his comments on our Executive Viewpoint page this month, you will find that he believes a vibrant UK oil-and-gas sector is required for a deliverable, affordable energy transition.

As Mr. Terrell accurately observes, the UK consumes twice as much oil and gas as it produces, and this ratio is projected to increase in the coming years. Simultaneously, recent events, like the conflict in Ukraine, have pointed up the importance of energy security. It is his belief that this situation requires a British policy of continued domestic oil and gas supply that includes exploring for new fields with ultra-low emissions. This approach, says Mr. Terrell, would not only slow the decline of UK production but also extend the infrastructure lifespan that is essential for upcoming CCUS and hydrogen projects. We encourage you to turn to the Executive Viewpoint column.

IN THIS ISSUE

Special focus: Artificial Lift. In this month’s lead theme, an author from ChampionX describes how integrating production expertise with digital capabilities drives next-generation autonomous well control solutions. Meanwhile, authors from AWS and Baker Hughes explain how leveraging automation in artificial lift production can boost field productivity and enhance operational efficiencies. In addition, two Halliburton experts examine the process of predicting viscosity correction factors for electric submersible pumps in viscous applications. Finally, in a separate Baker Hughes article, the author details how the industry’s first rig-less ESP system eliminates costly workovers to improve well economics.

Production optimization: New monitoring technology enables operators to verify perforations and troubleshoot more effectively. An author from Packers Plus Energy Services says that operators can gain actionable insight into downhole operations, utilizing an innovative, non-intrusive monitoring system. Stakes are high during on-site operations, and operators want as much information as possible to run a completion efficiently and troubleshoot problems effectively and immediately with minimal downtime. The new system’s goal is to foster an environment for confident decision-making to save time and reduce costs.

Digital transformation: Improved production outcomes with minimal capital investment. In all economic conditions, advanced analytics solutions help companies increase operational and business efficiency, empowering their people to get more out of existing assets,” says an author from Seeq. She says that it is not too early or too late to begin such initiatives; the time is now. Whether an enterprise has yet to begin evaluation, or is wrapping up a project with scaling efforts, companies must work on continuous improvement to get the most out of their data and assets.

- The last barrel (February 2024)

- Oil and gas in the Capitals (February 2024)

- What's new in production (February 2024)

- First oil (February 2024)

- E&P outside the U.S. maintains a disciplined pace (February 2024)

- Prices and governmental policies combine to stymie Canadian upstream growth (February 2024)