Dallas Fed: E&P activity increases, but costs and supply chain delays worsen

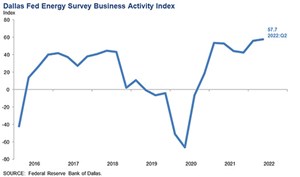

Upstream oil and gas activity in the southwestern U.S. increased for the second quarter in a row during Q2 2022, according to executives responding to the Dallas Fed’s Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—edged up to 57.7, its highest reading in the survey’s six-year history, Fig. 1. This was after jumping from 42.6 in Q4 2021 to 56.0 in Q1 2022.

OVERVIEW

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly, to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District (Texas, northern Louisiana, southern New Mexico).

Methodology. Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged, compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase.

When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting that the indicator has increased over the previous quarter. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Data were collected June 8-16, and 137 energy firms responded. Of the respondents, 85 were exploration and production firms, and 52 were oilfield equipment/service firms.

Special questions asked of executives included rating the impact of supply-chain issues on their firms; when do they expect their supply-chain issues to be resolved; rating the current availability of personnel, steel tubular goods, equipment, sand and chemicals; what are the primary reasons driving uncertainty in their companies’ outlooks; how much do they expect U.S. oil production to grow; how long it would take to drill and complete an additional well above and beyond current plans; and over the next 12 months, do their firms plan to target wells with a higher natural gas cut.

OIL & GAS PRICES

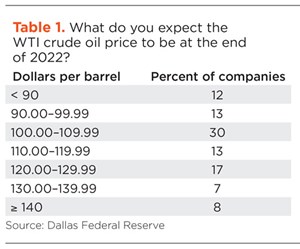

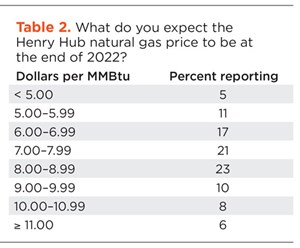

On average, respondents expect a West Texas Intermediate (WTI) oil price of $107.93/bbl by year-end 2022. This is up from a first-quarter average expectation of $93.26. Responses ranged from $65/bbl to $165/bbl, Table 1. Survey participants expect Henry Hub natural gas prices to average $7.55 per million British thermal units (MMBtu) at year-end, up a whopping 65% from the first-quarter average expectation of $4.57 per MMBtu. Responses ranged from $2.90/MMBtu to $12.00/MMBtu, Table 2. For reference, WTI spot prices averaged $119.56/bbl during the survey collection period, while Henry Hub spot prices averaged $8.38/MMBtu.

STRATEGY

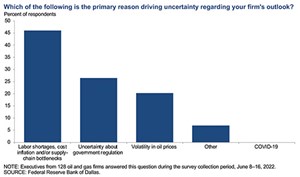

One of the “special questions posed to executives was “Which of the following is the primary reason driving uncertainty regarding your firm’s outlook?” As shown in Fig. 2’s chart, 46% of respondents cited “labor shortages, cost inflation and/or supply-chain bottlenecks.” Another 27% mentioned “uncertainty about government regulation,” while 20% pinned the blame on “volatility in oil prices.” Meanwhile, 7% cited “other” factors as the primary reason for uncertainty. It should be noted that no one mentioned Covid-19 (which was listed as an option) as their primary concern.

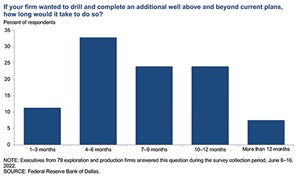

In addition, another special question quizzed executives on the notion that if they “wanted to drill and complete an additional well, above and beyond current plans, how long would it take to do so? As depicted in Fig. 3, bulk of answers ranged from a four-to-six-month period up to a 10-to-12-month period. The number one answer from 33% of respondents was four to six months. The next-highest number of answers was from 24% of executives for the seven-to-nine-month period, as well as 24% of respondents for the 10-to-12-month period. A hopeful group of 11% said it would be just one to three months, while a pessimist minority of 8% opted for “more than 12 months.”

COSTS/FACTORS

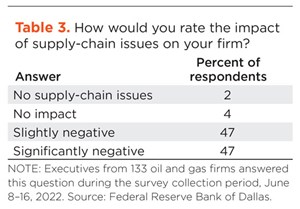

One of the “special questions” posed to executives was “How would you rate the impact of supply-chain issues on your firm?” The results shown in Table 3 are quite enlightening. Among operators in the 11th Fed District, 47% said that the impact was “significantly negative.” Another 47% said that it was “slightly negative.” This leaves just 6% that either said there were no supply-chain issues (2%) or there was no impact (4%).

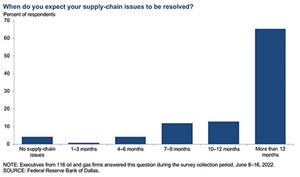

When asked, “When do you expect your supply-chain issues to be resolved,” executives took a very pessimistic stance, Fig. 4. Sixty-six percent of them said that they expect it will take more than a year to resolve supply-chain issues. Another 13% expect that it will require 10 to 12 months while 12% believe that it will take seven to nine months. Few executives expect resolution of supply-chain issues in six months or less. It should be noted that 4% of respondents said that their firms are not experiencing any supply-chain issues.

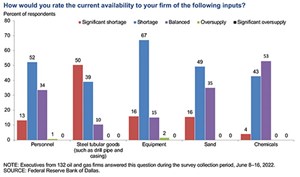

The final question of this supply-chain-oriented troika concerned the question, “How would you rate the current availability to your firm of the following inputs?” Firms were provided with five inputs (personnel, steel tubular goods, equipment, sand and chemicals) and were asked to rate their current availability—significant shortage, shortage, balanced, oversupply or significant oversupply, Fig. 5. Executives generally rated availability of steel tubular goods (particularly drill pipe and casing) as being in significant shortage. They also tended to rate availability of personnel, equipment and sand as in shortage. The availability of chemicals to firms was generally rate as balanced. Almost no executives rated the availability of inputs as being in oversupply or in significant ownership.

OIL PRODUCTION

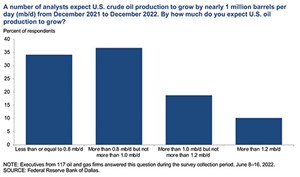

A number of analysts expect U.S. crude oil production to grow by nearly 1 MMbpd from December 2021 to December 2022. Accordingly, executives were asked, “By how much do you expect U.S. oil production to grow?” Most of them actually expect U.S. crude oil production to grow by 1.0 MMbpd or less, Fig. 6. Thirty-seven percent of respondents believe that U.S. oil output will increase by more than 800,000 bpd but not more 1.0 MMbpd. An additional 34% of executives expect U.S. oil output to grow by 800,000 bpd or less. Furthermore, 19% of respondents think that production will gain 1.0 MMbpd but less than 1.2 MMbpd. Finally, a group of 12% executives expect output to grow at a rate beyond 1.2 MMbpd.

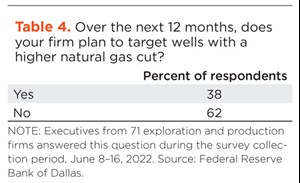

Speaking of increasing production through drilling, respondents were asked, “Over the next 12 months, does your firm plan to target wells with a higher natural gas cut?” In one of the more clear-cut sets of reactions, 62% of executives said their firm does not plan to target wells with a higher natural gas cut over the next 12 months, Fig. 4. The remaining 38% said their firms do plan to target such wells.

OFS SECTOR

Oilfield equipment and service firms reported improvement across key indicators. The equipment utilization index jumped from 50.0 in the first quarter to 66.7 in the second quarter. The operating margin index advanced from 21.3 to an astounding 32.7, which is a record high in this survey. The index of prices received for services increased from 53.2 to 62.7.

EMPLOYMENT TRENDS

All labor market indexes remained elevated during the second quarter, pointing to strong growth in employment, hours and wages. The aggregate employment index posted a sixth consecutive positive reading, but it declined from 28.0 to 22.6. This is indicative of a slightly slowing rate of expansion in a very active job market. The aggregate employee hours index remained positive, but it dipped from 36.0 to 31.4. The aggregate wages and benefits index decreased from 54.0 to 48.6.

Six-month outlooks improved significantly, with the index at 65.9, a highly elevated reading. The outlook uncertainty index remained positive but fell from 31.9 to 12.4. This suggests that while uncertainty continued to increase on net, fewer firms noted a rise during this quarter, as opposed to the previous quarter.

SPECIAL QUESTIONS COMMENTS

The following statements were received from operators and support services firms in reply to the survey’s Special Questions.

- EXPLORATION AND PRODUCTION (E&P) FIRMS

- Government animosity toward our industry makes us reluctant to pursue new projects.

- While the tariff exemption on steel from Ukraine is a step in the right direction, Ukraine’s mills are unable to quickly restart production. This will not increase steel product availability in the near term. We need to remove or reduce tariffs and quotas from other countries to increase availability.

- The real energy crisis isn’t even here yet. The U.S. Energy Information Administration forecasts U.S. oil production to average 12.5 MMbpd for the next 30 years. This is all but impossible. Shale will likely tip into terminal decline in about five years, as the main shale plays run out of locations. Unfortunately, by then, most of the individuals with incumbent knowledge about offshore and international development will have retired. The brain drain in the industry will create a real and much larger crisis in the mid-to-late 2020s.

- The current administration [in Washington] declared war on fossil fuels before going into office, and they have continued that war to this day.

- Mixed messages from politicians remain unhelpful to longer-term projects and commitments. Politicians need the reminder that a barrel of oil does not go directly into the gas tank of a car. Broadly speaking, permitting of all kinds remains difficult, if not impossible, and the lead times are forever.

- Although the question regarding availability of inputs has not affected me, it has had a significant impact on

business decisions, especially whether or not to drill and/or participate in new wells. - Analysts underestimate the impact of supply-chain disruptions and loss of efficiency of the contractors who

construct our wells, as equipment maintenance is done on the job site, and personnel have less training. - I hope this industry can weather the outrageous current assaults and the tidal wave of more of them to come

from the administration. - Many companies are planning an exit of their business.

OIL AND GAS SUPPORT SERVICES FIRMS

- Government regulations and the constant pounding on oil and gas companies and their suppliers certainly are causing a reluctance to invest in the business. When our government leaders are regularly demonizing the business, we shouldn’t be surprised that investors are not interested in supporting exploration for new supplies. The lag time to secure a return is measured in years or decades; who would invest when you have no certainty that the government won’t restrict or, even worse, guarantee you will not be successful?

- Those of us in oil and gas services businesses are very frustrated with those who push for elimination of fossil fuels now! Most folks do not comprehend the sheer number of everyday products that have some fossil fuel in their production. Would I like to see the use of fossil fuels reduced? Of course, I would—if not for my sake, then for the sake of my kids and grandkids and the generations to come. However, I wholeheartedly support a gradual shift away from fossil fuels in a well-conceived and structured plan of action—not “let’s get this done yesterday!”

- Wages in oil and gas support services firms increased 25% in 2021 and another 10%, so far, in 2022.

Rig hands are starting at about $85,000, with no experience and work half the year. - There is very little, if any, extra capacity of oilfield cement.

- FPSOs, reliability and gas turbine air intake filtration (February)

- From impossible to inevitable: Superhot rock geothermal to unlock gigawatts of energy (January)

- Halliburton’s ZEUS IQ™ powers the first fully autonomous fracturing platform with closed-loop automation (January)

- Making shale competitive (December 2025)

- Energy services: The relentless backbone of global energy security (December 2025)

- How space tech can help autonomous oil rigs become a reality (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)