ShaleTech: Haynesville-Bossier Shales

Amid the winter heating season, the movers and shakers in the dry gas Haynesville shale are looking well beyond domestic burner tips.

"In 2022, LNG (exports) are consuming over 11 Bcf a day, and that number is predicted to grow to 22 Bcf a day by 2027, as new facilities come online," says Rich Kinder, executive chairman of pipeliner Kinder Morgan, referencing an S&P Global forecast. "We project that after 2027, LNG demand will continue to grow and is expected to be 28 Bcfd by 2030. Given the situation in Europe today, which will result in more long-term contracts, and the continuing usage in Asia, this hyper-growth scenario actually seems pretty reasonable to me."

With year-over-year volumes for Haynesville up 70% in the third quarter, Kinder Morgan says its Louisiana and Texas assets transport around half of the gas flowing into the nearby Gulf Coast liquefied natural gas export (LNG) facilities. To be exact, the still-growing LNG network (Fig. 1) exported an average 11.1 Bcfd in the first half of 2021, mostly to help ease European supply disruptions caused by the Ukrainian war, with the U.S. Energy Information Administration (EIA) projecting medium exports will increase to 12.7 Bcfd next year.

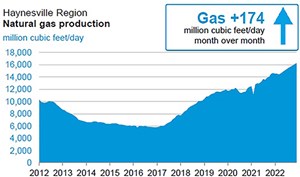

Thanks in no small part to expanding takeaway, the feedstock will be readily available from the over-pressured Haynesville and overlaying Bossier shales that stretch from the northern Louisiana fairway and into far East Texas. The comparative handful of public and tight-lipped privately held operators are on pace to continue this year's string of monthly production records, with a new high of 16,257 MMcfd expected in December (Fig. 2), breaking the previous record of 16,083 MMcfd set the month prior, according to EIA estimates.

This comes amid volatility in spot market prices on the Henry Hub benchmark, which reached a 2022 high of $9.85/MMBtu on Aug. 22, before settling at $5.90/MMBtu on Nov. 15. "Looking ahead to the fourth quarter, we expect gas prices to remain elevated and volatile, with the outlook heavily dependent on Russian pipeline flows and the severity of the Northern Hemisphere winter," BP CFO Murray Auchincloss said in a Nov. 1 call.

BP has provided no details on plans for this year, other than saying it "was looking at" mobilizing two or three additional rigs, split between its Haynesville and Permian basin assets. Early last year, BP's U.S. onshore entity, BPX Energy, drilled the company's first Haynesville well in 10 years.

As of Nov. 5, the Louisiana Department of Natural Resources (DNR) had issued 499 horizontal drilling permits in applicable Haynesville parishes this year, up from 360 new drills approved for the Nov. 5, 2020, to Nov. 4, 2021, period. In response, drilling activity, in what historically has been among the costlier shale plays to drill, has been relatively steady, with an average of just over 69 active rigs since mid-year, matching the 2022 high of 71 working rigs the week of Nov. 10, says Baker Hughes.

GETTING "LNG READY"

Meanwhile, with the EIA citing more than 15 Bcfd of LNG permitted in the next wave of Gulf Coast expansions, the world's largest exporting country is expected to add around 19 Bcfd in incremental export capacity by 2026.

Operators are gearing up for the projected boost in demand over the next two years. Chesapeake Energy Corp. signed a 300-MMcfd gas supply agreement (GSA) in August with the Golden Pass LNG terminal near Sabine Pass, Texas, which is on track to begin shipping cargoes in 2024, Fig. 3. The one-time regasification facility is adding gas liquefaction and export capabilities in a $10-billion expansion spearheaded by QatarEnergy and ExxonMobil. The three-train project is designed for a total capacity of 2.4 Bcfd.

Chesapeake President and CEO Domenic Dell'Osso says the company intends to be "LNG-ready, as the macro tailwinds from the significant increase in demand, due to export capacity expansions, arrive in the second half of the decade. As export capacity doesn't begin to increase until at least 2024, we're setting up our near-term volumes to be relatively flat and begin to ramp slowly as we approach 2024."

After producing 1.61Bcfd in the third quarter, Chesapeake expects to close out the year with production between 1.6 Bcfd and 1.7 Bcfd. The company added a seventh rig in the fourth quarter, when it will drill 14 to 20 new wells, with seven to 13 wells turned-in-line, Fig. 4. For the year, Chesapeake will have drilled 60 to 66 wells at average laterals of 9,000 ft, with 65 to 71 wells put on production. Following the $22-billion acquisition of Vine Energy Co. in November 2021, Chesapeake controls roughly 350,000 net acres in the Louisiana fairway.

The vast majority of those new drills have targeted the Haynesville, as the high cost of the Bossier does not yet justify a significant investment, says EVP and COO Josh Viets. "The Bossier, in general, is a more challenging formation for us. I mean, it is shallower, but the lithology and the rock type make it a little bit more difficult from a drilling and completion standpoint, so that's ultimately what ends up driving some of your cost differences," he said. "At this point, I don't think we would pivot away from that. We think that's a really important interval for us to continue to develop, but obviously, it represents a relatively modest part of the program."

A year removed from expanding beyond its Appalachian basin foothold and making its Haynesville debut, Southwestern Energy Co., likewise, has emerged as one of the premier suppliers to the Gulf Coast petrochemical and LNG corridor. The company says 65% of the estimated 5 Bcfd of gross production from the Haynesville and Appalachian assets are delivered to LNG export terminals. "This large-scale, dual-basin supply to the Gulf Coast has enabled us to become one of the largest suppliers of natural gas to the LNG sector," says President and CEO Bill Way.

Cumulative third-quarter Haynesville production was 176 Bcf, with 15 wells drilled and completed, and 17 wells put online at average lateral reaches of 9,332 ft. Southwestern estimates full-year 2022 net production will average 1.8 Bcfed to 1.9 Bcfed.

Southwestern controls 257,000 net acres in Louisiana, largely courtesy of two back-to-back acquisitions last year. In November, the company bought GEP Haynesville, LLC for $1.85 billion, which followed September's $2.7-billion deal for Indigo Natural Resources. "We've been encouraged by the results and learnings to date," COO Clay Carrell said, on Oct. 28 of Southwestern's one-year anniversary as a Haynesville player. "We've successfully extended lateral lengths on average from less than 7,000 ft to approximately 9,000 ft in 2021, reduced cycle times and implemented more efficient completion designs."

Operating two self-owned rigs, the company plans to drill 60 to 65 gross Haynesville wells this year, with 65 to 70 wells completed and up to 75 put to sales.

In comparing its two-basin footprint, Carrell says costs are the primary differentiator. "As we went through 2022, we realized higher inflation in the Haynesville than in Appalachia. And as we've started our contracting process for 2023, that trend is continuing, maybe moderating a little bit, but Haynesville a little higher than Appalachia."

MAJOR SETBACK

Though it has yet to dispatch a single molecule—and is unlikely to do so anytime soon—would-be LNG exporter, Tellurian Inc., is nonetheless amassing a sizeable gas stockpile.

Operating under a unique integrated model, Tellurian's upstream entity closed out the third quarter with cumulative gas production of 11.4 Bcf, up 25% from the prior three months and a nearly three-fold increase from the same quarter in 2021. While Tellurian has provided no update on current activity, DNR records show the company being issued five drilling permits this year, with the last one on Nov. 3.

The Houston-based company controls 22,420 net acres in the Haynesville, including the 5,000 acres and roughly 45 MMcfd of production in DeSoto, Bossier, Caddo and Webster parishes, added in the $125-million August acquisition of privately held EnSight IV Energy Partners, LLC.

However, Tellurian's efforts to finance the continued development of its $12-billion Driftwood LNG export terminal in Lake Charles, La., encountered a double whammy in September, when "havoc in the debt markets" forced the jettisoning of a $1-billion, high-yield bond sale, followed by the scrapping of two of the three purchasing agreements signed last year. Days after the bond deal was pulled, Shell and global energy trader Vitol terminated separate, 10-year purchase agreements that would have taken a cumulative 6 million tonnes per annum (mtpa) from the 27.6-mtpa Driftwood terminal that began initial construction in April.

The abandoned offering, "puts in jeopardy the financial ability to deliver gas on the schedule that we were hoping to stick to," Executive Chairman Charif Souki conceded in a video posted on the company's website.

Tellurian is now turning to the equity market in hopes of finding partners to finance the build-out of Driftwood, which had been expected to deliver first LNG next year, with full operations scheduled for 2026. "The money is most likely to come from certain strategic partners, because that's where the money is today," Souki said. "They've all indicated they'd like to participate in an American energy project."

As of Nov. 1, "Tellurian is fully engaged in our efforts to secure strategic equity partners," said President and CEO Octávio Simões.

TEXAS BOUND

Elsewhere, after making its bones in the Louisiana core, high-flying Comstock Resources, Inc. is throwing its weight across the border, drilling its first set of wells in nearly eight years. Two Haynesville and one Bossier well were drilled and completed on a new pad in the roughly 35,000 net acres the company holds in Nacogdoches County, Texas, with initial production (IP) ranging from 33 MMcfd to 40 MMcfd.

Of its current nine-rig fleet, two recently added rigs will be dedicated solely to Texas next year. "Looking ahead in a more general sense, we plan to shift more of our drilling activity from Louisiana into Texas, as we spread out the activity to maintain our takeaway capacity, maximize where we can drill the longer laterals and to protect our acreage," says CEO Jay Allison.

Comstock Resources is not alone. The Texas Railroad Commission (RRC), the state's chief regulator, issued roughly 437 new gas well drilling permits from Jan. 1 to Nov. 16, to a smattering of mainly privately controlled operators in the Haynesville-specific District 6, compared to 284 authorizations for the like period in 2021. Of the permits issued in 2022, Rockcliff Energy, LLC, a leading privately held gas producer, received 97 new drill approvals across a 270,000-net-acre East Texas leasehold.

While the Calpine, Texas-based operator notes production of more than 1 Bcfd, it declined to comment on current volumes or activity levels. In March, the company was said to be weighing prospective takeover options that could reach $4 billion, but as of now, no transactions are imminent.

For its part, Comstock was issued roughly 20 Texas drilling permits this year for acreage spread across Nacogdoches, Harrison and Panola counties. Since selling its Bakken shale acreage in October, Comstock operates exclusively in the Haynesville, where the two-state leasehold totals 372,000 net acres.

In what it described as the "greatest quarterly results in our 30-plus-year history as a public company," Comstock recorded third-quarter production of 1.4 Bcfed. Over the first nine months of the year, the company drilled 52 gross (42.4 net) wells with 53 gross (44.2 net) wells put onstream at an average IP of 27 MMcfd.

Compared to their higher-profile Louisiana counterparts, Texas Haynesville-Bossier wells typically deliver lower IP and more water, but they make up for those deficiencies with flatter declines and, more importantly, lower costs. "The wells in Texas are a little bit cheaper to drill," says COO Daniel Harrison. "We drill faster in Texas, and we've got the acreage in Texas to drill a lot of long laterals, so that's going to help us there."

BOOSTING TAKEAWAY

While the EIA cites constraints in the nation's gas pipeline capacity, more than 6 Bcfd of additional takeaway capacity is expected to connect Haynesville wells with the Gulf Coast petrochemical and LNG center by year-end 2024. Among the highest-profile projects in various stages of development, Momentum Midstream reached a final investment decision (FID) in September on what it calls a new-generation gas gathering project that will provide up to 1.7 Bcfd of takeaway capacity, from the Haynesville to the Gulf Coast. The Momentum network is expected to be in service in the second half of 2024.

Unique to the project, which is expandable to 2.2 Bcfd, is a still-developing carbon capture and sequestration component, designed to permanently isolate up to 2 mtpa of carbon dioxide (CO2) at the Gillis, La., delivery point.

Chesapeake signed on as an anchor tenant, with a commitment of 700 MMcfd, and says it is likely to exercise an option to take on a 35% equity position. "This gives us greater than 1 Bcfd, or more than 50% of 2024, and beyond Haynesville volumes that are contracted for Gulf Coast delivery and pricing with both the Momentum pipe and our Golden Pass transaction," says Dell'Osso.

Southwestern also committed to providing 300 MMcfd to the Momentum network, along with the 500 MMcfd earmarked for DT Midstream's 155-mi LEAP network that is expected to begin transporting Haynesville gas to the Gulf Coast by late 2023 or early 2024. WO