Regional Report: The Arctic

In the Arctic Circle, oil and gas interests are often a study of polar opposites. To some it looks like riches; for others, potential ruin.

Canada is in the self-imposed doldrums of its moratorium on Arctic development, while next door, the U.S. is buying, selling and opening new areas. On the other side of the ocean, Russia continues to develop large onshore gas resources and connect them to markets in Europe and China. Just last year, it upped the offshore game by revisiting Kara Sea operations long idled by U.S.-imposed sanctions.

Other perspectives from members of the Circle include producer Norway, where Barent Sea activity continues; and non-producers Greenland and Iceland, where seismic and hope persevere. Fig.1.

UNITED STATES - ALASKA

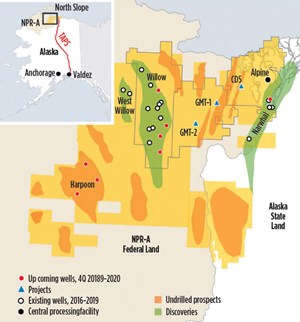

Alaska’s Arctic is keeping an active E&P pace with new players, investment, and fresh opportunities spread across a vast onshore and offshore area, Fig 2.

ANWR. The Coastal Plain Oil and Gas Leasing Program in the Arctic National Wildlife Refuge (ANWR) was approved in August to a muted industry response and an animated phalanx of opposition lawsuits. It’s a start that perhaps presages the area’s foreseeable future.

“At current and foreseeable oil prices, the industry’s appetite to drill in ANWR will be exceptionally low and quite possibly will be zero,” Pavel Molchanov, energy analyst at Raymond James, told CNN Business. On the other hand, and to no surprise, multiple plaintiffs including state governments, Alaskan Native tribes, and the Audubon Society, quickly filed federal lawsuits citing environmental concerns.

The ANWR program, administered by the Bureau of Land Management (BLM), determines terms and conditions for leasing in the 1.56-million-acre Coastal Plain, located within the 19.3-million-acre ANWR, Fig. 3. The first lease sale must occur before Dec. 22, 2021, and offer at least 400,000 acres for bidding; a second sale must happen prior to 2024. The Coastal Plain is estimated to contain recoverable oil reserves of 4.25 Bbbl to 11.8 Bbbl.

NPR-A. West of ANWR, in the 23-million-acre Alaska National Petroleum Reserve (NPR-A), a December 2019 BLM lease sale offered 350 tracts totaling 3.98 million acres. The successful sale leased about 25% of the acreage offered, with a total of $11.3 million bid, well ahead of 2018’s $1.5 million for about 6% of tracts offered.

Of the three companies participating, the most active was newcomer North Slope Exploration. It acquired 85 leases across the middle of the reserve. Emerald House acquired four tracts, and ConocoPhillips acquired three in the eastern area near existing leases.

Beaufort Sea. The 2019-2024 National OCS Oil and Gas Leasing Draft Proposed Program (DPP) provided for three OCS Oil & Gas lease sales in Alaska’s Beaufort Sea: One each in 2019, 2021 and 2023. The schedule is still pending, according to the Bureau of Ocean Energy Management, which reports it is preparing the environmental impact statement. And there is no updated word on the fate of the 2021 and 2023 sales.

State sales. The State of Alaska’s December 2019 lease sale received $7.8 million for leases on 154,610 acres of state land on the North Slope and Beaufort Sea. While not as strong

as the NPR-A sale that month, the state viewed it as a positive auction, with 56 bids on North Slope tracts and 13 bids on tracts in the Beaufort Sea area.

Bidding on state lands was dominated by Oil Search Alaska, which is developing the large Nanushuk oil project in the Pikka Unit. Oil Search acquired about 40 leases focused on the area south of the Point Thomson gas field, according to the Anchorage Daily News.

Alaska Division of Oil and Gas Director Tom Stokes noted that many bids in the December sale came from companies with significant lease acreage. He said they appeared to represent efforts to consolidate opportunities around existing leases.

The sale complements ongoing work in Arctic oil fields, said Stokes. “Current plans of development indicate up to 10 wells will be drilled this winter, to confirm the size and reach of oil fields. And we’re getting quite a bit of inquiry about permits for 3D seismic work that could direct future exploratory work.”

ALASKA OPERATORS

Hilcorp Alaska. Hilcorp concluded the first part of its acquisition of BP’s Alaska assets. With the July sale, the company became one of the largest operators in Alaska, and BP took a big step in its exit from the state. Hilcorp joins ConocoPhillips and Exxon Mobil as the state’s top three producers.

The upstream sale is the larger portion of a two-part, $5.6-billion agreement that includes the 800-mi Trans Alaska Pipeline System. It transferred working interest in 176 oil and gas leases within the Prudhoe Bay, Point Thomson and Milne Point oil and gas fields. Hilcorp also took on BP’s operator role at the Prudhoe Bay unit.

Hilcorp has nearly tripled its Alaskan workforce to more than 1,400 employees and expects to add more, according to a statement in Alaska Public Media. BP said about half of its Alaskan employees have joined Hilcorp.

ConocoPhillips. In April, the Covid-19 pandemic caused an early end to ConocoPhillips’ 2020 winter exploration program, but not before the company finished drilling two additional appraisal wells on its Willow discovery and one well to test the Harpoon prospect. Among the idled assets was the newly arrived “Beast,” Doyon Rig 26, billed as the largest land rig in the world, and built for ConocoPhillips’ extended-reach drilling (see World Oil, November 2019).

ConocoPhillips’ Alaska program is a mix of development drilling, small projects within core fields, large new projects, and exploration. In a November 2019 analyst meeting, the company reported improvements in waterflood management and EOR over the past few years have reduced its decline rate from 8% to 6%. Data analytics are being used to optimize gas lift operations, and the company is implementing predictive analytics and artificial intelligence to minimize equipment downtime.

Growth is coming from steady development of the western North Slope, and exploration opportunities related to the Willow and Narwhal discoveries. Alaskan production is roughly 95% oil, and about 75% of its exploration portfolio is undrilled, Fig. 4.

The Willow Master Development Plan Final Environmental Impact Statement (EIS) was finalized in August. Its focuses on a broad scope of developments, including a central processing facility; infrastructure pad; up to five drill pads with up to 50 wells per pad; access and infield roads; an airstrip; pipelines; a gravel mine; and a temporary island to support module delivery via sealift barges.

The Willow prospect is centrally located in the Bear Tooth Unit of the NPR-A, west of the Alpine development. It is envisioned as a new hub for the North Slope. A final investment decision (FID) is expected in 2021, with first production in 2025 or 2026.

The company has added four pad drilling sites in recent years, including the Alpine CD5 unit and Kuparuk’s Northeast West Sak area. Upcoming projects include the Greater Mooses Tooth unit, where first oil is expected in 2021. The unit will produce 48 planned wells to existing Alpine facilities.

Development of the recently acquired Nuna unit will allow oil production start-up in 2022 through a tie-back to Kuparuk. Prudhoe Bay also will get several “incremental” projects. Narwhal production is slated to start in 2022, reports ConocoPhillips.

The efforts continue a program of record length laterals, aimed at maximizing recovery while minimizing footprint. The CD5 unit claims ten of the longest lateral wells in Alaska, including the recent Narwhal appraisal that set a 32,000-ft North American record.

Even-longer laterals are anticipated. The “Beast” can drill more than 7 mi away from the pad. The company expects that the new ERD rig will facilitate reaching 100 MMbbl at $25/bbl.

The Narwahl test established high productivity, with a peak rate of over 4,500 bopd. To the west, Willow unit testing of wells in 2018 established high productivity and good inter-well connectivity; another injection well was planned in 2020. Further west, four more appraisal wells are planned at Willow, plus three exploration wells to the southwest at Harpoon.

Data from the 2020 appraisals will help finalize the Willow and Narwhal design. Harpoon is next, with a similar seismic signature but also the possibility of stacked pay horizons. About half of the Narwhal development wells will be drilled from the existing CD4 pad and produce to the Alpine facilities. A new pad, CD8, will be built to access the balance of production from that pad in 2025.

ENI. At the start of the year, Eni acquired the remaining 70% interest and operatorship of Oooguruk oil field in Alaska from Caelus Natural Resources. Eni already owned a 30% working interest.

The Beaufort Sea field is about 3 mi off the coast. Started in 2008, it produces about 10,000 bopd from 25 producing wells and 15 gas/water injector wells. Production facilities are on an artificial gravel island, in about 5 ft of water.

Eni is the operator (100% working interest) of Nikaitchuq oil field, which is about 8 mi northeast of Oooguruk. Nikaitchuq has been in production since 2011 and currently produces about 18,000 bopd.

The Oooguruk acquisition, said Eni, increases its Alaskan production by approximately 7,000 bopd, gross, and facilitates operational synergies and optimizations between Oooguruk and Nikaitchuq, both operated at 100%.

Eni plans to drill more production wells in both fields, aimed at increasing its total Alaskan production beyond 30,000 boed. In August 2018, the company acquired 124 exploration leases (for a total of approximately 350,000 acres) on the Eastern Exploration Area, southeast of Prudhoe Bay.

RUSSIA

Russian E&P continues its gas focus, with a particular emphasis on tying huge Yamal Peninsula gas assets to a pipeline infrastructure running east and west. New operations in the Kara Sea are noteworthy, with a return to a sanctions-idled discovery, and construction plans for a new platform, Fig. 5.

Rosneft. Six years following sanctions that suspended Kara Sea drilling in a venture with ExxonMobil, Rosneft said in mid-August that it was making hole again. In 2014, the Rosneft and ExxonMobil JV’s first and only well in the Kara Sea, the Universitetskaya-1, discovered the Pobeda oil field.

Two appraisal wells were being drilled in the Vostochno-Prinovozemelsky 1 and 2 license areas off the Novaya Zemlya archipelago. The cumulative reserves of these areas amount to almost two billion tonnes of oil and 3.7 Tcm of gas, said Rosneft.

At work are two drilling platforms brought in from Murmansk. The structures have been retrofitted with drilling equipment, submersibles and iceberg monitoring systems. To prevent iceberg damage, Rosneft is using a novel design for the Russian shelf that places the wellhead below the sea floor in a shaft 15 m deep and almost 2 m in diameter.

Gazprom. Construction began in June on an ice-resistant, offshore production platform for development of the Kara Sea’s Kamennomysskoye-Sea gas field. The ice-resistant platform will initially enable drilling of 33 directional production wells, with additional satellite wells anticipated. The field in Ob Bay, between the Gyda and Yamal peninsulas, is expected to begin production in 2025. It is estimated to have gas reserves of 55 Bcm.

Platform construction is widely dispersed. Components are being built as far away as Astrakhan on the Caspian Sea, and will be assembled in Kaliningrad on the Baltic Sea. The schedule calls for towing the platform to the field in the summer of 2024.

Gazprom said the gravity base platform design includes a V-shaped hull for ice protection, hull-enclosure of equipment for cold and wind protection, and zero-discharge waste systems.

On the Yamal Peninsula, the Bovanenkova gas field hub is the site for a new petrochemical plant that can produce about 3 million tons of plastics. The field produces about 115 Bcm of gas per year. In proximity are several other fields, including Kharasaveyskoye and Kruzenshternskoye, that are expected to start coming online in the near future. Gazprom expects, within a few years, that it will produce as much as 180 Bcm of gas on the peninsula.

The first Kharasaveyskoye field well was spudded in June. Gas reserves reportedly amount to about 2 Tcm. It is the second-most important field in the Yamal gas province after Bovanenkova field, according to Gazprom.

Development of Semakovskoye gas field in the Yamal-Nenets Autonomous Area moved ahead with the project’s FID, said Gazprom. Project operator, RusGazAlyans, conducted onshore pre-development design and survey work, including construction and commissioning of production and transmission facilities.

The field, offshore in Taz Bay and on land in the Taz Peninsula, has recoverable gas reserves of more than 320 Bcm. Commercial production from the field is slated for 2022, at which time 19 wells will have been drilled.

Gazprom plans to build a new gas export system out of the Yamal region. The Power of Siberia 2 pipeline system will join the eastern distribution network with the far west Power of Siberia pipeline, and forms the basis for a new route to China via Mongolia that may carry up to 50 Bcm per year.

In July, Gazprom Neft started supplying crude from its Novy Port Arctic oil field to China, with the delivery of 144,000 tons of crude from Murmansk to Yantai. The company has been delivering crude to European countries since 2013. Its operations include the Prirazlomnaya oil production platform, the Arctic Gates oil terminal in the Gulf of Ob, a reinforced ice-class tanker fleet, including LNG-fuel vessels, escort icebreakers, and an offshore oil shipment terminal in Murmansk.

NORWAY

In the Barents Sea, Equinor said it would consolidate activity around recent discoveries. Tim Dodson, Equinor ‘s executive VP for exploration, told Bloomberg that their activity would focus less on Arctic frontier areas in favor of higher prospect areas closer to the Johan Castberg and Wisting discoveries.

Last year, Equinor and its partners announced the Sputnik discovery that confirms oil north of the 2013 Wisting discovery. Both wells are north of the 2013 Johan Castberg field, slated for FPSO production in 2022. Other recent Barents Sea discoveries include Skruis (2018, Equinor), and Filicudi (2017, Lundin Norway AS) in the Johan Castberg area.

The only fields in production are Snøhvit (Equinor) and Goliat (Var Energi AS), which went onstream in 2007 and 2016, respectively. Snøhvit gas is transported by pipeline to an LNG facility; Goliat production goes to an FPSO, and gas is reinjected.

GREENLAND

Arctic resources are central to Greenland’s new cooperation agreement with the U.S. The April deal includes a $12.1-million aid package, aimed at economic development, that includes oil and gas. While it has no production, Greenland has potential. Seismic in 1982 was followed by several leasing rounds. Last year, Greenland announced a 2021 onshore round and pointedly noted the interest of China’s CNOOC.

ICELAND

Southeast of Greenland, Iceland holds out hope for a slim slice of Arctic hydrocarbons with its Dreki and Gammur offshore areas. But in 2018, 2D seismic in the areas to the north and west resulted in the return of the only three Dreki exploration permits, and no further activity is reported.