Innovative strategy increases profitability of ultra-deepwater fields

For nearly two decades, operators working in the Gulf of Mexico have had little success developing the massive reserves of Lower Tertiary projects in ultra-deep waters. They have failed, primarily, because their attempts to adapt subsea systems for exploitation of these complex resources have been thwarted by technological challenges, lengthy appraisal processes, and high-cost Phase 1 subsea development schemes with unacceptable levels of risk.

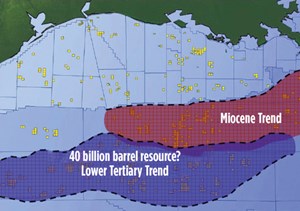

Lower Tertiary wells are the deepest, most complex and highest-pressure wells in the GOM, Fig. 1. High-pressure Paleogene reservoirs are in extreme water depths (4,000 to 10,000 ft) and exhibit mudline pressures that can approach and exceed 15,000 psi. Wells drilled into these formations may reach total measured depths of up to 40,000 ft. Significant reservoir uncertainties, which stem from a lack of production history and overhanging salt canopies, make seismic imaging extremely challenging and provide further barriers to project sanction.

Historically, operators have drilled numerous, costly appraisal wells to gather static information from electric logs and cores. But this static information still does not provide the industry with the critical insights needed to de-risk a project and determine commerciality. These factors require production and completion performance information to adequately define:

- Faulting and connectivity

- Depletion drive mechanism

- Sand control needs

- Intervention requirements

- Reserve recovery per well.

Without dynamic reservoir information, these questions remain unanswered, making it difficult for operators to justify expensive high-risk investments to exploit this deepwater resource. As a result, despite estimates of 40 Bboe reserves in place, the Lower Tertiary remains essentially undeveloped.

INNOVATIVE SOLUTION

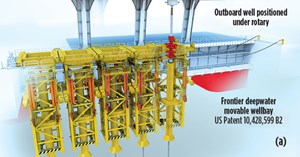

In response to the hurdles that have stalled development of the Lower Tertiary, Frontier Deepwater Appraisal Solutions (FDAS) has conceived a simpler, adaptive and standardized system that allows operators to capture critical dynamic reservoir data with a phased development strategy. The basic concept involves converting a 6th- or 7th-generation MODU capable of drilling Paleogene wells from top to bottom. Operators will have direct access to critical well systems equipment because the converted unit will maintain full drilling capabilities.

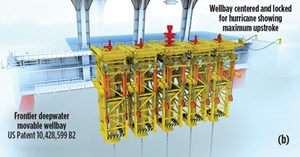

The conversion includes removing the marine drilling riser, subsea BOP and DP system, which frees up ample space and weight to install a production module and moveable wellbay, Fig. 2. As a result, the modified system incorporates a full 2.5 MM lb drilling, completion, intervention, workover and sidetrack rig on a 65,000 bopd production platform.

The deepwater Frontier Production System (FrPS) reduces risk and costs by building on the precepts that have worked successfully for onshore shale fields, including:

- Use reliable completions and technology

- Provide inexpensive drilling, completion, long-term maintenance and intervention

- Use the pad concept to drill and develop a “cube,”

which in this case is more reservoir acreage than

contained in one OCS block.

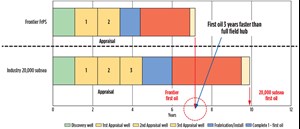

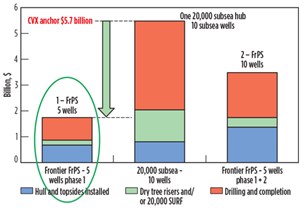

The patented, movable wellbay technology provides billions of dollars in economic advantages over more expensive, less reliable 20,000-psi subsea developments. An FrPS incorporating the movable wellbay can be delivered and installed in about half the time and cost of a purpose-built subsea “hub” system and, because it is a phased approach, operators can confidently and profitably sanction initial field developments with fewer up front appraisal wells (2 or 3 instead of the 5 or 6 that has been standard so far). Depending on reservoir performance, the operator can subsequently add future phases faster (or condemn the asset) at less cost than is possible with the subsea-hub approach.

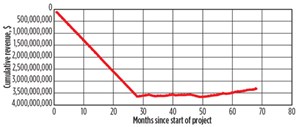

Further, the FrPS is a dry tree solution; dry tree completions have historically delivered much higher reserve recovery compared to wet trees. For a complex 400-MMbbl resource, this advantage may mean as much as 100 MMbbl of additional lifetime production, which would add $5 billion in revenue, compared with a subsea system. Due to the speed at which first and peak production can be achieved by reducing the number of appraisal wells to sanction a five-well development, this revenue “bonus” comes at the front end of the project, doubling the value of early adoption, Fig. 3. The FrPS provides these benefits using:

- A converted 6th-generation semisubmersible

- A 65,000-bopd production module

- A moveable wellbay supporting five dry tree wells

- A permanent taut-leg mooring system

- Oil and gas export risers with pipeline tie-ins to regional infrastructure.

Shifting the appraisal paradigm.Let’s review several of the large industry discoveries. BP discovered Kaskida in 2006, and yet 13 years later, despite the 3 Bbbl thought to be in-place, it still has not been developed. BP has drilled a total of nine wellbores costing several billion dollars and still cannot come up with a 20,000-psi subsea production development plan that is economic. Anadarko discovered Shenandoah in 2009. After 10 years and the drilling of 14 appraisal boreholes, Anadarko was unable to come up with a workable 20,000-psi subsea development plan. Again, several billion dollars were expended to acquire well logs and cores. However, no dynamic reservoir performance or completion information was obtained, which are critical to answering key commercial questions needed to sanction the development.

The FrPS provides operators with the means to move forward more quickly with fewer appraisal wells while obtaining the dynamic reservoir information profitably at oil prices of less than $50/bbl. The total installed cost of the FrPS is less than half that of a new subsea hub development, and first oil is accelerated by several years while providing the dynamic reservoir information required to fully optimize field development, Fig. 4. A Phase 2 development can include subsea tiebacks or even another FrPS to maximize resource recovery.

The cost comparison shows that the savings are not coming from platform costs; those are similar. The increased efficiencies come from the significant reduction in drilling and completion costs by using a platform rig versus a dedicated HPHT MODU. The rig is purchased on the FrPS, and the operating dayrate is the drilling contractor services and crew along with the loaded dayrate services associated with dry tree operations. Historically, these dayrates are less than half of a MODU operating on a subsea field (reference Mad Dog, Holstein and Mars).

CASE STUDY

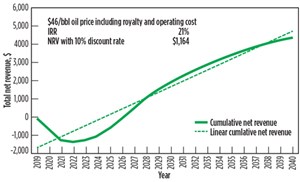

The FrPS system can help operators save billions of dollars on appraisal wells and effectively de-risk their deepwater projects. The FrPS system provides operators key information required to get the most recovery from the resource at the lowest possible cost and risk. To highlight the potential benefit of the FrPS system, a hypothetical case study is presented, using an initial well production rate of 15,000 bopd, based on existing BSEE production data from Lower Tertiary production. Figure 5 shows the resulting economics of a five-well FrPS at a $45/bbl flat oil price, including royalty and operating cost. The system is robust—even at $45/bbl—providing 20% IRR and $1.2 billion-dollar NPV at a 10% discount rate.

This compares favorably to several other fields developed with a subsea hub concept that have been plagued with poor bottom hole locations and complex subsea hardware reliability problems. These issues have resulted in expensive downtime and/or maintenance from DP MODU’s operating at more then $1 million per day. These fields were developed with existing 15,000-psi technology, and have been an operations challenge. Figure 6 shows an example of one of these fields using current production history from publicly available BSEE information at $55/bbl. With these poor economic results, the commercial viability of these projects are in serious doubt.

The FrPS is needed to change the game to win in the Lower Tertiary. With dynamic reservoir information obtained from this initial five-well development, operators may proceed with additional phases in possession of a higher degree of reservoir certainty. Frontier’s phased approach provides operators with significantly more value than the traditional subsea development scenario.

CONCLUSION

For decades, as operators moved to deeper water and more complex environments, the E&P industry has repeatedly turned to engineering innovation to meet evolving technological and economic challenges. To exploit the vast reserves of the Lower Tertiary, the industry must once again turn to engineering innovation rather than attempting to mutate a subsea supply chain solution built for other reservoir types in which drilling, completion and maintenance are not the cost drivers, as in the Lower Tertiary. The FrPS is an engineering innovation—a step change centered on the realization that, unlike times past, it is the cost of drilling and completion, as well as access to dynamic reservoir data, and not the production facility that must drive development decisions.

The FrPS is a solution for the Lower Tertiary because a phased approach reduces cost and risk as follows:

- Reduces appraisal well requirements

- Reduces spend by 50% compared to a subsea development

- Delivered in 3 years or less

- Eliminates the need for drillship contract

- Earlier dynamic reservoir information

- Increases completion access and reserve recovery with direct vertical access

- Safer hydraulic controlled equipment

- Permanently moored with fully rated dual barrier risers

- Standardized develop scheme

- Can be moved and reused over a wide range of water depths.

The moveable wellbay technology is also applicable to new construction. For example, TLPs and deep-draft floaters, such as spars, benefit, because the rig may be built lower into the platform, eliminating the heavy and expensive rig skidding systems on the top deck. In doing so, the drilling systems and utilities become simpler, and the overall platform size and complexity can be reduced.

- The evolution of remote-controlled FPSOs (January)

- What's new in production: Welcome diversion? (December 2025)

- Keeping the Gulf of America as our energy anchor (December 2025)

- Recovering more from mature fields: How technology and digital are changing the game (December 2025)

- Oil and gas in the capitals: Norway sustains the industry (December 2025)

- Riserless coiled tubing intervention cuts time and cost by half (December 2025)

- Subsea technology- Corrosion monitoring: From failure to success (February 2024)

- Applying ultra-deep LWD resistivity technology successfully in a SAGD operation (May 2019)

- Adoption of wireless intelligent completions advances (May 2019)

- Majors double down as takeaway crunch eases (April 2019)

- What’s new in well logging and formation evaluation (April 2019)

- Qualification of a 20,000-psi subsea BOP: A collaborative approach (February 2019)