U.S. crude output surges, gas reaping benefits of LNG expansion

Unrelenting activity in the U.S. shale plays pushed oil production up to 11.58 MMbpd in November, making the U.S. the world’s largest petroleum producer, surpassing Russia and Saudi Arabia. The booming unconventional reservoirs have turned the country into a net oil exporter for the first time in 75 years. This rise in U.S. output is due largely to decisions by OPEC and Russia to curb their production, to support benchmark prices.

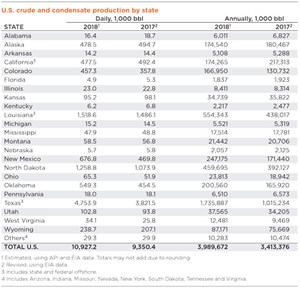

Crude oil. Overall, U.S. oil production increased 17% in 2018, with noticeable increases reported in Texas, New Mexico, North Dakota, Colorado and Oklahoma. WTI prices rose after January 2018, from around $63 in the first part of last year, and topped out at $70/bbl in October. But in late 2018, crude benchmarks declined 18% in November and continued on a downward trajectory, as WTI plunged to just $42.50 on Dec. 24, only to jump back to over $48 on Jan. 4.

The escalating benchmark prices during the first three quarters of 2018 caused U.S. production to climb, with daily average output jumping to 10.927 MMbpd in 2018, compared to 9.350 MMbpd in 2017. Texas oil production climbed 24%, increasing to a daily average of 4.8 MMbpd in 2018, due to sustained drilling activity in the Permian and Eagle Ford shale plays. On the New Mexico side of the Permian play, production increased 44%, up to 677,000 bopd, the largest percentage gain of any state. Similarly, Bakken production in North Dakota registered a 17% output increase, up to 1.259 MMbopd.

In the Western states, Colorado enjoyed a 28% increase to 457,000 bopd, and Wyoming was up 15%. California’s production remained resilient at 478,000 bopd, a loss of just 3%. In the Mid-continent, production in Oklahoma shot up 21%, with operators focusing on the SCOOP/STACK plays, but shale-poor Kansas dropped 3%, to average 95,000 bopd. While Louisiana and the federal offshore increased 22%, up to 1.5 MMbopd, Alaska was not as fortunate, dropping 3% to 479,000 bopd.

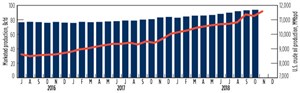

Natural gas. Henry Hub spot natural gas prices averaged $3.15/MMBtu in 2018, up $0.16/MMBtu from 2017. HH prices surged to average $3.94/MMBtu in November, but quickly retreated to historical levels. EIA predicts that HH gas will average $2.89/MMBtu in 2019 and $2.92/MMBtu in 2020. U.S. LNG exports are projected to increase from 3.0 Bcfd in 2018 to 5.1 Bcfd in 2019, and to 6.8 Bcfd in 2020, as three new liquefaction projects come online. The agency also predicts that U.S. LNG export capacity will almost double by the end of 2019, to 8.9 Bcfd. Marketed gas production was 93.7 Bcfd in October 2018 versus 80.8 Bcfd in October 2017. ![]()

Related Articles

- Shale technology: Bayesian variable pressure decline-curve analysis for shale gas wells (March 2024)

- U.S. producing gas wells increase despite low prices (February 2024)

- U.S. drilling: More of the same expected (February 2024)

- U.S. oil and natural gas production hits record highs (February 2024)

- Management issues- Dallas Fed: Activity sees modest growth; outlook improves, but cost increases continue (October 2023)

- U.S. upstream muddles along, with an eye toward 2024 (September 2023)