|

Oct.

2001 Vol. 222 No. 10

Feature Article

|

REGIONAL REVIEW

Mexico’s Northern Region launches massive development

Part 1 – To satisfy rapidly growing demand,

the Northern Region unit of state firm Pemex will be engaged over the next several years in large-scale

development of natural gas reserves. Technical advances and regulatory reforms will aid this effort that focuses

first on the Burgos basin

Maclovio Yanez, Subdirector, Northern Region,

Pemex Exploracion y Produccion, Poza Rica, Mexico

olding

33% of Mexico’s proved gas and oil reserves, the Northern Region unit of Pemex Exploracion y Produccion

(PEP) offers big challenges and opportunities. It has two very important gas-producing basins, Burgos and

Veracruz, Fig. 1. The region offers huge potential resources, both onshore and offshore. olding

33% of Mexico’s proved gas and oil reserves, the Northern Region unit of Pemex Exploracion y Produccion

(PEP) offers big challenges and opportunities. It has two very important gas-producing basins, Burgos and

Veracruz, Fig. 1. The region offers huge potential resources, both onshore and offshore.

|

|

Fig. 1. At the moment, gas development

in Pemex’s Northern Region is concentrated in the Burgos and Veracruz basins. |

|

Development of resources in the Northern Region is a

cornerstone of current Pemex natural gas policy. Faced with rapidly growing gas demand, the company is rapidly

looking at innovative methods to increase output. One of these methods still under consideration is a proposal

to solicit investment in, and participation by, private operators in the exploration and development of gas

fields. A first step in this direction is the current evaluation of multiple services contracting for field

reactivation projects within Mexico’s constitutional and legal framework. At the same time, the federal

government is preparing a proposal that will be submitted to Congress. It calls for an even wider opening of

natural gas exploration and exploitation to foreign companies.

Economic Indicators

In recent years, the Northern Region’s income and

profit before taxes have registered important increases, due to several reasons. These include natural gas

production growth contributed by the Burgos basin project; an aggressive policy of cost reduction; and the

favorable behavior of gas and oil prices. From a situation where operating losses were registered annually

during the 1992 – 1994 period, the region has improved its performance considerably, resulting in

profits.

Regarding industrial safety, the rate of accidents has

been reduced significantly, and PEP shall continue working to improve it. Credit for the accident rate

reduction should be given to implementation of the Corporate Safety Program (SIASPA).

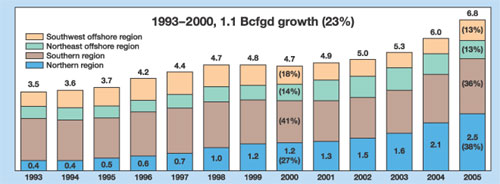

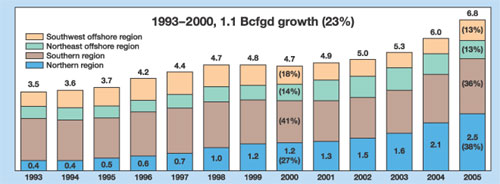

During the 1993 – 2000 period, Mexico increased

its gas production 23%, to 1.1 Bcfd, Fig. 2. The Northern Region provided 75% of this growth, or 825 MMcfgd.

Within the region, gas output grew 187%. PEP projects that in the future, the Northern Region will make an

even stronger contribution to the country’s gas business. This greater level of participation, beginning

in 2005, will be based on a solid portfolio of projects.

|

|

Fig. 2. When Mexico’s gas

production increased 23% during the seven-year period ending in 2000, three-quarters of the growth

came from the Northern Region. |

|

The Northern Region counts nine gas projects among its

current portfolio. This group includes five onshore and four offshore projects, and they are distributed

fairly evenly along the northern Gulf of Mexico coastline.

Burgos Basin Project

At the moment, the most important gas project in the

Northern Region is the Burgos Basin Project, Fig. 3. Most of the reservoirs are in tight sands and the

productive zone is divided in three areas with 170 discovered fields at present time. These areas include the

eastern part, with the older fields of Reynosa and Monterrey; the central part that contains the

Arcabuz-Culebra complex, which represents the most important fields nowadays; and the western portion, with

excellent fields such as Arcos and the Oasis-Corindon-Pandura complex.

|

|

Fig. 3. Additional development has

pushed gas output from Burgos basin fields well beyond the original 1970 peaks of 620 MMcfd, to a new

high of more than 1.0 Bcfd. |

|

Over the last several years, Burgos has come to

represent one of the most successful, mature field reactivation cases worldwide. This is shown by the area’s

production history.

First gas output was achieved in 1945, when Mision

field began producing. The basin’s production peaked in 1970, at 620 MMcfgd, and then declined to 215

MMcfgd in 1993. This drop-off was caused by a reduction in drilling activity, because investments were

redirected to important oil projects in Tabasco and Campeche.

The Burgos basin’s renaissance began during 1994

and 1995. In 1994, PEP assembled an integrated work team to conduct a feasibility study, aimed at evaluating

the basin’s remaining potential and increasing production from those reserves. In making its evaluation,

the team took into account the gas production observed in Railroad Commission District 4 of neighboring South

Texas, as well as the discoveries at Bob West field in Zapata County. The study’s findings spurred the

drilling of 91 development wells, which increased production to 420 MMcfgd from 215 MMcfgd. Due to these good

results, Pemex in 1997 authorized a very significant budget of more than $5.6 billion to further develop the

Burgos basin resources. This can be considered the "official" beginning of the current Burgos Basin

Project.

In 1998, the previous production peak of 620 MMcfgd was

exceeded, thanks to the new development effort. A year later, in May 1999, output increased further, to 1.0

Bcfgd. Present production now exceeds that figure. By 2005, the project goal is to reach sustained output of

1.4 Bcfgd. Net present value is $3.4 billion, which could grow to $7 billion, assuming a price of $4/Mcf. From

January 1997 to July 2001, the project had a net cash flow of $500 million. The process of reactivating most

of the mature fields is in progress, and there is an aggressive program to develop the new fields derived from

exploratory activity. As a matter of fact, more than 26 fields have been reactivated, and the plans consider

the drilling of more than 4,000 production wells and about 270 exploratory wells. The 2001 work program for

the Burgos basin specifies drilling 420 wells, of which 40 will be exploratory and 380 will be for development

(see table). This should boost output to at least 1.1 Bcfgd by the end of the year.

| |

Table 1. Pemex E&P 2001 gas program |

|

| |

Activities |

Amounts, $ millions |

|

|

|

|

| |

Drilling services for 420 wells

(Bits, tubing, casing, logs, fluids, drilling rigs spares, etc.) |

350 |

|

| |

Well completions (Fractures, shoots,

coil-tubing, desanders, production logs, etc.) |

160 |

|

| |

2-D & 3-D seismic acquisition |

150 |

|

| |

Production infrastructure (Roads,

locations, flowlines, pipelines, gathering stations, compression, etc.) |

130 |

|

| |

Material and equipment acquisitions,

and three new drilling rigs |

120 |

|

| |

Plays and prospects studies

(Software, hardware and consulting) |

50 |

|

|

|

|

Veracruz Basin Project

Another important national gas project is located in

the Veracruz basin, covering a 15,000-sq-km prospective area. The Veracruz Project has a large number of

exploratory and development opportunities, and the exploratory component remains particularly strong. The

exploratory opportunities are in the Tertiary and Mesozoic formations. The Tertiary sector produces dry gas

from Miocene sands, while in the Mesozoic area, wet gas is extracted from Cretaceous limestones. The area

features low production costs, thanks to highly productive, shallow wells. In addition, there is existing

transportation infrastructure nearby.

PEP is evaluating a potential resource of 7.1 Tcf, with

the goal of increasing reserves by at least 1.5 Tcf. To reach a conservative production level of 350 MMcfgd,

another 417 wells will be drilled. Of these, 117 will be exploratory and 300 will be for development.

One example within the basin is the San Jose de las

Rusias area, which contains 26 exploration opportunities. There is sour gas production present, exemplified by

the Lerma 9 (16.3 MMcfgd) and Verde 101 (5.5 MMcfgd) wells in a shelf margin Upper Jurassic play.

Offshore Projects

Regarding offshore areas, the country has a huge

hydrocarbon potential. PEP has evaluated probable average resources of 131 billion boe in Mexico’s

offshore areas, but only about 1,000 wells have been drilled so far. By contrast, in the U.S. portion of the

GOM, 37 billion boe have been exploited, with more than 36,000 wells drilled.

There are four offshore projects, all of them in water

depths of less than 600 ft, Fig. 4. They feature sand sequences and an extensional fault system. They are also

near the coastline and access to onshore facilities.

|

|

Fig. 4. The four offshore gas projects

in Pemex’s Northern Region collectively offer 129 identified exploratory prospects. |

|

Within the Delta del Bravo project area, 32 exploratory

prospects have been identified. As concerns the Lamprea, Lankahuasa (Lankahuasa means "Good son" in

Totonaca dialect) and Veracruz Marino projects, they all have approved, good potential locations that are

ready to be drilled. One of these, Lankahuasa 1, will be drilled this year. At Lamprea, 31 exploratory

opportunities have been identified, of which two locations have been approved for drilling. The Lankahuasa

project has 56 prospects, of which seven were referred for drilling consideration. On the southern end of the

offshore sector, the Veracruz Marino project has identified 10 exploratory opportunities, with two already

approved for drilling.

Handling The Challenges

The Northern Region will face the challenges posed by

the gas development plan through a series of deliberate measures. Given the orientation toward boosting gas

production, PEP will continue to conduct a relatively stout amount of exploration activity. Efforts to achieve

cost reductions will be maintained and expanded. As an example, the Burgos Basin Project this year increased

its drilling program 85%, with only a 15% increase in its budget.

Likewise, PEP will continue the application of

selective technology, whose efficiency has been proved, to develop new prospects, as well as rejuvenate

existing fields. An example of field rejuvenation is Arcos field in the Burgos basin. There, 3-D seismic was

acquired and an integral study was carried out. The Arcos 10 well was reentered, and it was deviated to deeper

sands, leading to new discoveries. This confirmed the field’s potential in deep intervals, and a new

development program was established to reactivate exploitation of the field, which had been shut-in years ago.

Now, with more than 100 producing wells, Arcos produces 200 MMcfgd.

PEP has strengthened its work philosophy, uniting

different disciplines through multidisciplinary teams, for the integral evaluation of projects. Regarding

industrial safety and environmental protection, the company is strictly enforcing existing regulations.

Finally, a quality culture, which is vital for growth in all organizations, must be fully consolidated in the

Northern Region.

Editor’s note: This article is adapted

from a presentation prepared for delivery to a meeting of the National Oil Equipment Manufacturers and

Delegates Society (NOMADS) chapter in Houston. Part 2 will examine Pemex E&P’s plans for further oil

exploration and development in the Northern Region.

The author |

|

Maclovio Yanez

graduated from Polytechnic National Institute (IPN) in Mexico City after completing bachelor of

engineering studies. He subsequently earned a masters degree with honors from National University of

Mexico (UNAM). During his career at Pemex, Mr. Yanez has held a diverse range of technical and

administrative positions. Since 1995, he has served as subdirector of Pemex Exploration and Production’s

Northern Region. He has participated in several national and international congresses, especially those of

the Association of Petroleum Engineers of Mexico (AIPM). Mr. Yanez has been awarded four gold medals by

AIPM, including the Juan Hefferan Vera medal (1984) and Lazaro Cardenas medal (1995) for best technical

work; as well as the Antonio J. Bermudez medal twice (1989 and 1998) for best administrative work. He is

member of the Mexican Engineering Academy, the College of Petroleum Engineers of Mexico, the Society of

Petroleum Engineers (Mexico section) and AIPM. |

| |

|

|

Part

2 Part

2 |

|