Nov. 2001 Vol. 222 No. 11

Feature Article

|

REGIONAL FOCUS: MEXICO

Mexico’s Northern Region launches massive development

Part 2 – In a two-pronged approach, Pemex E&P's Northern Region will focus short-term efforts on large-scale rehabilitation of mature oil fields, while long-term projects will include development of the large Chicontepec reserves and exploration of offshore prospects

Maclovio Yanez Mondragon, Sub-director, Northern Region, Pemex Exploracion y Produccion

orthern Mexico offers excellent potential, as well as great challenges, for development of additional oil resources. The Northern Region of Pemex Exploracion y Produccion (PEP) contains 33% of the country’s proved oil reserves. orthern Mexico offers excellent potential, as well as great challenges, for development of additional oil resources. The Northern Region of Pemex Exploracion y Produccion (PEP) contains 33% of the country’s proved oil reserves.

However, the area will require rejuvenation of many mature, oil-producing fields, and there is a need to optimize secondary recovery systems. There are also extended onshore and offshore areas that are potentially very attractive for exploration. In tandem with the natural gas projects detailed in last month’s article, PEP intends to mount an expanded oil development effort within the Northern Region over the next several years.

Oil Project Portfolio

Mexico’s onshore oil activity is concentrated in the Gulf of Mexico coastal plain. Probable oil and gas resources in the Mexican portion of the Gulf, conservatively evaluated, are 131 billion boe. By contrast, the U.S. portion of the Gulf features accumulated production of 37 billion boe after the drilling of 36,000 wells.

However, there is important potential in other basins. Some of these represent the continuation of known producing basins in the U.S. One such case is the Chihuahua basin, which relates to the Permian basin of the U.S. Mexico, also offers good potential in the Gulf of Cortes and in some areas of the Pacific Ocean littoral.

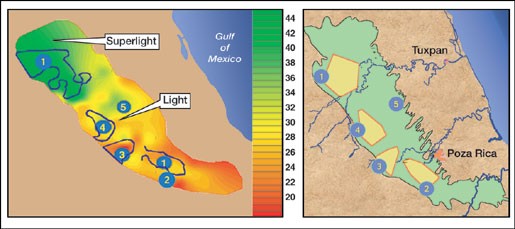

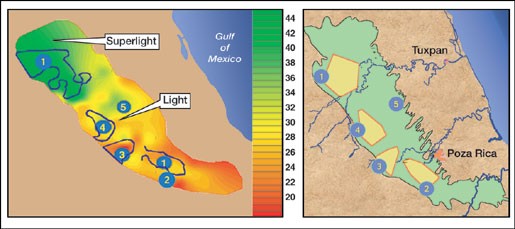

The Northern Region counts 11 important oil projects among its portfolio. Among these items are four offshore exploratory areas (Sardina, Cazones, Golfo de Mexico Sur and Area Perdido) and six mature field optimization projects (Arenque, Bagre-Atun-Marsopa, Poza Rica, San Andres, Tamaulipas-Constituciones and Tres Hermanos), Fig. 1.

|

Fig. 1. In addition to Chicontepec field, the Northern Region’s portfolio of oil projects includes six mature fields and four exploratory prospects.

|

|

Chicontepec Field

In addition, the most important effort is, undoubtedly, the Chicontepec project. It represents an opportunity and a challenge at the same time, because it contains Mexico’s largest, certified hydrocarbon reserve, totaling more than 19 billion boe, with original oil in place (OOIP) greater than 139 Bboe. The 3,731-sq-km (1,440-sq-mi) area also contains a certified gas reserve of 34.1 Tcf, and 932 wells have been drilled to date. Given these figures, attractive production scenarios can be assumed.

In Chicontepec, there are strong engineering and technology challenges to face, due to the low permeability that is characteristic of the reservoirs (0.01 to 100 md), the complex sands distribution (maximum porosities of 14%) and low recovery factors for crude on the order of 7% to 10%. By contrast, the recovery factor for gas is 60% to 70%. Nevertheless, it must be emphasized that the presence of light and super-light oil (18° to 45°API) significantly increases the project’s value, Fig. 2.

|

Fig. 2. The presence of light and super-light oil (18° to 45°API) increases the Chicontepec project’s value, enabling PEP to focus on four areas where almost 3,000 wells can be drilled.

|

|

| |

Chicontepec scope, number of wells |

|

| |

Area

ration |

Development |

Re-entry/

Explo |

|

|

|

|

| |

1 – Amatitlan/ Tzapotempa/ Profeta/ Vinazco |

1,000 |

21 |

|

| |

2 – Agua Fria/ Coapechaca/ Tajin |

446 |

17 |

|

| |

3 – Coyula/ Japeto |

700 |

12 |

|

| |

4 – Tablon/ Humapa |

750 |

15 |

|

| |

Subtotal |

2,896 |

61 |

|

| |

5 – Other areas |

11,200 |

190 |

|

|

|

|

| |

Total |

14,096 |

251 |

|

|

|

|

For Chicontepec, the strategy established by PEP will focus on four areas, where almost 3,000 wells can be drilled, Fig. 2. However, it will require delineating these areas further with additional exploratory activity. There must also be further application of leading-edge drilling and completion technology, to reduce the number of wells. In turn, this will allow PEP to reduce the amount of capital invested in the project as much as possible. Likewise, it will be prudent to continue testing secondary recovery technology at the site.

Offshore Prospects

There are four offshore, oil exploration projects underway. Two of these have great long-term potential – the Area Perdido (in the border zone with the U.S.) and Golfo de Mexico Sur, located in the deepwater sector of the GOM, where much more than 100 exploratory opportunities have been identified.

The most outstanding sites are the Sardina and Cazones projects, because they contain light oil and are in water depths less than 600 ft. At the Sardina project, there are three discovered fields with proved reserves, plus six exploratory locations waiting to be drilled.

One of the short-term opportunities available is to undertake rejuvenation of mature oil fields. Exploitation of these fields can be optimized by conducting additional drilling that enables more efficient recovery of remaining reserves. These fields will need to make optimum use of artificial lift and secondary recovery. One should also call attention to light oil projects that either have or may have significant reserves, such as Poza Rica and Arenque fields.

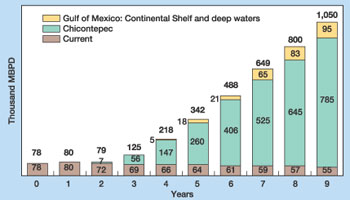

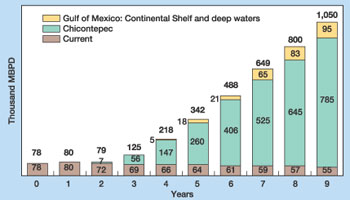

In fact, there is a very important growth picture emerging, with a potential gain of more than 1 million bopd, based mainly within Chicontepec and the Gulf of Mexico projects, Fig. 3.

|

Fig. 3. Significant prospects for crude production growth exist within Chicontepec and the Gulf of Mexico projects.

|

|

Final Considerations

Mirroring the preference given to PEP’s gas projects, the Northern Region will continue giving special attention to those oil projects that feature light crude and certified proved reserves. Short-term efforts will focus on rehabilitation of mature, light oil fields, while longer-term goals for the Northern Region will include development of the large Chicontepec reserve and the huge potential in the Gulf of Mexico.

Given these realities, the Northern Region has real, achievable growth opportunities, both for oil and natural gas.

The author

|

|

Maclovio Yanez graduated from Polytechnic National Institute (IPN) in Mexico City after completing bachelor of engineering studies. He subsequently earned a masters degree with honors from National University of Mexico (UNAM). During his career at Pemex, Mr. Yanez has held a diverse range of technical and administrative positions. Since 1995, he has served as sub-director of Pemex Exploracion y Produccion’s Northern Region. He has participated in several national and international congresses, especially those of the Association of Petroleum Engineers of Mexico (AIPM). Mr. Yanez has been awarded four gold medals by AIPM, including the Juan Hefferan Vera medal (1984) and Lazaro Cardenas medal (1995) for best technical work; as well as the Antonio J. Bermudez medal twice (1989 and 1998) for best administrative work. He is a member of the Mexican Engineering Academy, the College of Petroleum Engineers of Mexico, the Society of Petroleum Engineers (Mexico section) and AIPM.

|

| |

|

|

Part 1 Part 1 |

|